Corruption By Any Other Name – Oliver DeMille

April 25th, 2014 // 10:41 am @ Oliver DeMille

Another Domino Falling

JP Morgan recently settled a case brought by the government, agreeing to pay Washington $13 billion for its role in the mortgage bubble meltdown.

Morgan recently settled a case brought by the government, agreeing to pay Washington $13 billion for its role in the mortgage bubble meltdown.

This creates a very dangerous standard. When something bad happens, Washington will naturally seek to find fault in a place that brings it a lot of extra cash—the most profitable businesses.

As Ken Kurson put it:

“This settlement sets a terrible precedent. Companies with strong balance sheets can expect to become targets of the government…”[i]

This is another domino in the decline of our freedoms, and it’s a big one. This new approach allows, even incentivizes, government corruption. Let’s review how this process works:

- The federal government passes laws that require or incentivize businesses to give loans or offer services/products to people who can’t actually afford them. Businesses that refuse are penalized.

- As a result of this kind of bad policy, many businesses fail. Businesses that comply, but only make middling profits, are left alone.

- Businesses that comply, and make big profits, are targeted by the federal government and end up paying huge sums of money to the government.

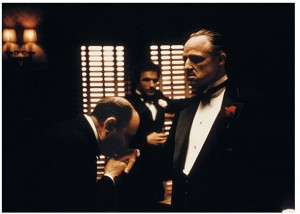

Godfather Over Again

This is a great racket. It’s akin to a mafia protection scheme: “You need protection from us. We’ll provide it, for a fee. The fee will be set by us, without appeal or negotiation. If you don’t pay it, we’ll hurt you and/or your business—thus proving that you really did need protection.”

An official term for this new precedent is “corruption.” Except that the Supreme Court gets to determine the actual definition of the word. And who gave the Court the power to do this?

The Supreme Court did, in a string of cases starting in 1803 through 1936.

Is this recurring pattern starting to make sense?

“Wait,” the critics say. “The crash was real! And JP Morgan and other companies that participated need to pay! Right?”

As Kurson wrote:

“Of course, most of JP Morgan’s wrongdoing—70 to 80 percent of the exposure—was committed by two companies, Bear Stearns and Washington Mutual, it acquired in 2008 at the request, to the point of command, of then-Treasury Secretary Henry Paulson. JPM acquired those companies as acts of mercy during a crisis.”[ii]

Let’s get this straight. The economy was tanking, so the government demanded that JP Morgan buy two flailing firms—to help save the economy. Then, when the fall came, the government targeted JP Morgan for the mistakes of these two firms and made it pay for them.

Godfather corruption indeed.

Who It Hurts

How are businesses responding to this emerging new economy? Many are closing. Others are going abroad, to China, India, Brazil, etc. Those that make enough from the U.S. economy simply pay the fines, settlements, and fees—it’s the cost of doing business.

The real problem is for American workers and families. JP Morgan has increased its litigation reserve up to $23 billion (from $3 billion in 2010).[iii] Other companies are learning to do the same.

What happens when the extra billions are refocused this way? Money moves away from salaries and purchases, the economy is hurt, private sector jobs are cut or curtailed.

The government is currently seeking similar payoffs from a number of other big companies. As this precedent sends its ripples through the economy, it will harm a lot of families.

More firms will move operations and jobs abroad, and others will shift more money from jobs and put it to litigation and fees.

Old Pattern, New Cloth

Oh, and just re-read the government’s pattern outlined above for the mortgage bubble, but this time read it with Obamacare in mind:

- The federal government passes laws that require or incentivize businesses to offer services/products to people who can’t actually afford them. Businesses that refuse are penalized.

- As a result of these bad policies, many businesses fail. Businesses that comply, but only make middling profits, are left alone.

- Businesses that comply, but make big profits, are targeted by the federal government and end up paying huge sums of money to the government.

This really is as shocking as it sounds. Yes, this really is happening in the United States.

The worst news in all this is that most people will do nothing about it, because this kind of financial news is considered technical mumbo jumbo.

Citizens usually just ignore it. “What can I do, after all?” is the typical response.

This is how freedoms decline: slowly for a while–then all at once. The amazing part is that when the “all at once” crash comes, almost everyone acts surprised.

But what can a regular person do? Really? It’s not like you can stop government overspending, party bickering, or a growing culture of corruption with a call to your Congressman or a letter to the editor.

The answer to this major post-modern question (What can a regular person do?) is interesting: We can start with not being surprised.

Problems and Solutions

We can know what is coming. A government addicted to spending and borrowing, and constantly increasing its spending and borrowing, is going to cause problems for the economy and for its citizens.[iv]

A government addicted to increased regulations is going to cause problems.[v]

A government that demands official secrecy from its own people while increasing how it spies on its own citizens is going to cause problems.[vi]

A government that inflates its currency and borrows from its biggest enemies and competitors is going to cause problems.[vii]

A government whose top officials routinely make promises during elections or to pass big agendas and then break them once they win is going to cause problems.[viii]

A government that uses statistics it knows distort reality (just revising them a few months later once decisions have been made), in order to support its continued ideological course, is going to cause problems.[ix]

A citizenry that turns a collective blind eye to these realities is enabling the very problems it fears. Then the people claims surprise when the crash comes.

Anyone who is surprised by the next crash has been lying to themselves for a long time.

False Recovery

As Allan Greenspan wrote in November 2013:

“One can hope that in a future financial crisis—and there will surely be one…”[x]

Calomiris and Haber noted that banking crises should be expected:

“The banking system in the United States has been highly crisis-prone, suffering no fewer than 14 major crisis in the past 180 years.”[xi]

The question isn’t if, but when, the next one will come.

Or consider what J. Bradford DeLong wrote in a piece in Foreign Affairs titled “The Second Great Depression: Why the Economic Crisis is Worse Than You Think”:

“The U.S. economy has enjoyed a recovery [since 2009] only in the sense that conditions haven’t gotten worse…. But it is unlikely that the economic downturn will be over by 2017…”[xii]

Greenspan suggested the second thing people can do. He wrote:

“Financial firms could have protected themselves…if…they had prepared for a rainy day.”[xiii]

Though he addressed this belated counsel to companies, it certainly applies to regular people as well.

Time and Two Steps

To summarize, we have covered two things a regular person can do about our current problems. First, know about them. Pay attention. Keep a close eye on the government, the economy, and current events. Read the fine print and the technical mumbo jumbo put out by government.

The English word for this daily activity and focus is “citizenship.”

The second is to prepare. Look around, see what is really needed, and what is likely to be needed in the years ahead—and take action to help your community flourish.

Not just for you, but for others.

The word for this kind of initiative and foresight is “entrepreneurship.” It isn’t pessimistic, doomsayer, or extreme. In fact, effective entrepreneurialism is precisely the opposite.

It only works if it is optimistic, positive, and sustained.

Without such citizenship and entrepreneurialism, the decline of freedom is only going to accelerate. We’ve still got time for these two things to work, but time is running out.

[i] Ken Kurson, “The Portfolio,” Esquire, February 2014.

[ii] Ibid.

[iii] Ibid.

[iv] See, for example, Edward Conard, “How to Fix America: Which Tools Should Washington Use? Unleash the Private Sector,” Foreign Affairs, May/June 2013. See also: Fareed Zakaria, “Can America Be Fixed?: The New Crisis of Democracy,” Foreign Affairs, January/February 2013. For example: “In 1980 the United States’ gross government debt was 42 percent of its total GDP; it is now 107 percent.”

[v] Ibid. For example, the United States is ranked 76th in the world for its “burden of government regulations.”

[vi] See Jack Shafer, “Live and Let Live,” Foreign Affairs, March/April 2014. “[A]ccording to the White House review panel convened last year to examine the NSA’s surveillance practices, the bulk collection of phone records has stopped precisely zero attacks.”

[vii] See, for example, Minxin Pei, “How China and America See Each Other: And Why They Are On A Collision Course,” Foreign Affairs, March/April 2014. For example: “In 2007, the United States’ economy was four times as large as that of China; by 2012, it was only twice as large.”

[viii] E.g. “If you want to keep your doctor, you can keep your doctor.” See also: Michael A. Cohen, “Hypocrisy Hype: Can Washington Still Walk and Talk Differently?” Foreign Affairs, March/April 2014.

[ix] See Zachary Karabell, “(Mis)leading Indicators: Why Our Economic Numbers Distort Reality,” Foreign Affairs, March/April 2014.

[x] Allan Greenspan, “Never Saw It Coming: Why the Financial Crisis Took Economists by Surprise,” Foreign Affairs, November/December 2013.

[xi] Charles W. Calomiris and Stephen H. Haber, “Why Banking Systems Succeed and Fail: The Politics Behind Financial Institutions,” Foreign Affairs, November/December 2013.

[xii] J. Bradford DeLong, “The Second Great Depression: Why the Economic Crisis is Worse Than You Think,” Foreign Affairs, July/August 2013.

[xiii] Op Cit., Greenspan.

Category : Blog &Business &Citizenship &Community &Current Events &Economics &Entrepreneurship &Leadership &Liberty &Mini-Factories &Mission &Politics &Uncategorized

C. David Green

7 years ago

Oliver, I have been a fan for a few years, but I have been enlightened during this past electoral process with your recent teachings.

Thank you for putting it in a means which I can better understand. I knew this corruption was going on, but I really did not understand it.

Thank you!