America’s Looming Crash: Special Report Parts I, II, III

January 9th, 2015 // 7:56 am @ Oliver DeMille

I am an optimist. I believe the best of America and the world are still ahead. But we’re only going to get there by dealing with the reality that the United States is now in an era of significant decline. Specifically, at least two things happened this year that are major problems, and a third serious problem is gaining increased support among many world leaders.

Part I

First, our federal debt went over the $18 trillion mark in 2014. Someone is going to have to pay this back, and that means we’ll be paying for it for the rest of our lives—and so will our children and grandchildren.

First, our federal debt went over the $18 trillion mark in 2014. Someone is going to have to pay this back, and that means we’ll be paying for it for the rest of our lives—and so will our children and grandchildren.

That’s approximately $58,065 for every man, woman, and child currently in the United States. If you have a family of four, you now owe around $232,260. This debt must be paid in addition to whatever other taxes are needed for national security, services, and all other government programs now and going forward–not to mention your family’s living expenses.

To be more realistic, the truth is that many people will never pay any taxes toward this amount—because they won’t make enough. This means you’re likely to end up being charged at least twice this amount. Some people will pay a lot more. So you really owe more like $116,130 or $464,520 for your family of four.

If you have big family, say of ten people, you owe roughly $2 million dollars over the course of the rest of your life. Whatever you don’t pay off, the government will charge your kids and grandkids.

Oh, and you need to add to that all the interest still to be charged on this amount, which means that you actually owe between $1.8 million if you have a family of four, or up to around $7 million if your family is bigger. And, yes, if interest rates on the national debt increase (all the trends indicated they will), this amount will go up rapidly.

Most people have no idea what a big deal this is. This is money that has already been spent. It’s owed. And we have to pay it, now and later. We, our kids, and their kids too.

Problems and Booms

How big is this? Multiply your salary by the number of years you have left working (x), and then multiply at least $116,130 by the number of years you have to live (y). If you make more than $60,000 a year, double both amounts. If you make more than $100,000 a year, quadruple both. Then subtract one from the other to find if you’ll make more than you already owe the government.

Too much math? That’s exactly what the government is banking on. The government only gets away with this level of borrowing and spending because very few people do the math or understand what it means to them personally. Granted, these numbers are very basic, and the reality is actually worse, given interest and rising interest rates on the national debt.

So, the United States has a problem. It has a number of problems, actually, but this one is massive. The government owes so much that our economy will struggle under the weight of this debt for the rest of the century. It will dampen every citizen’s opportunities, block every generation’s choices, and haunt our posterity for many decades.

Is there any way out of this? Yes. The answer is simple, in fact. We need a major economic boom. A massive boom would allow us to pay this off much quicker and put the nation back on positive economic footing. Without such a boom, this problem is going to deepen.

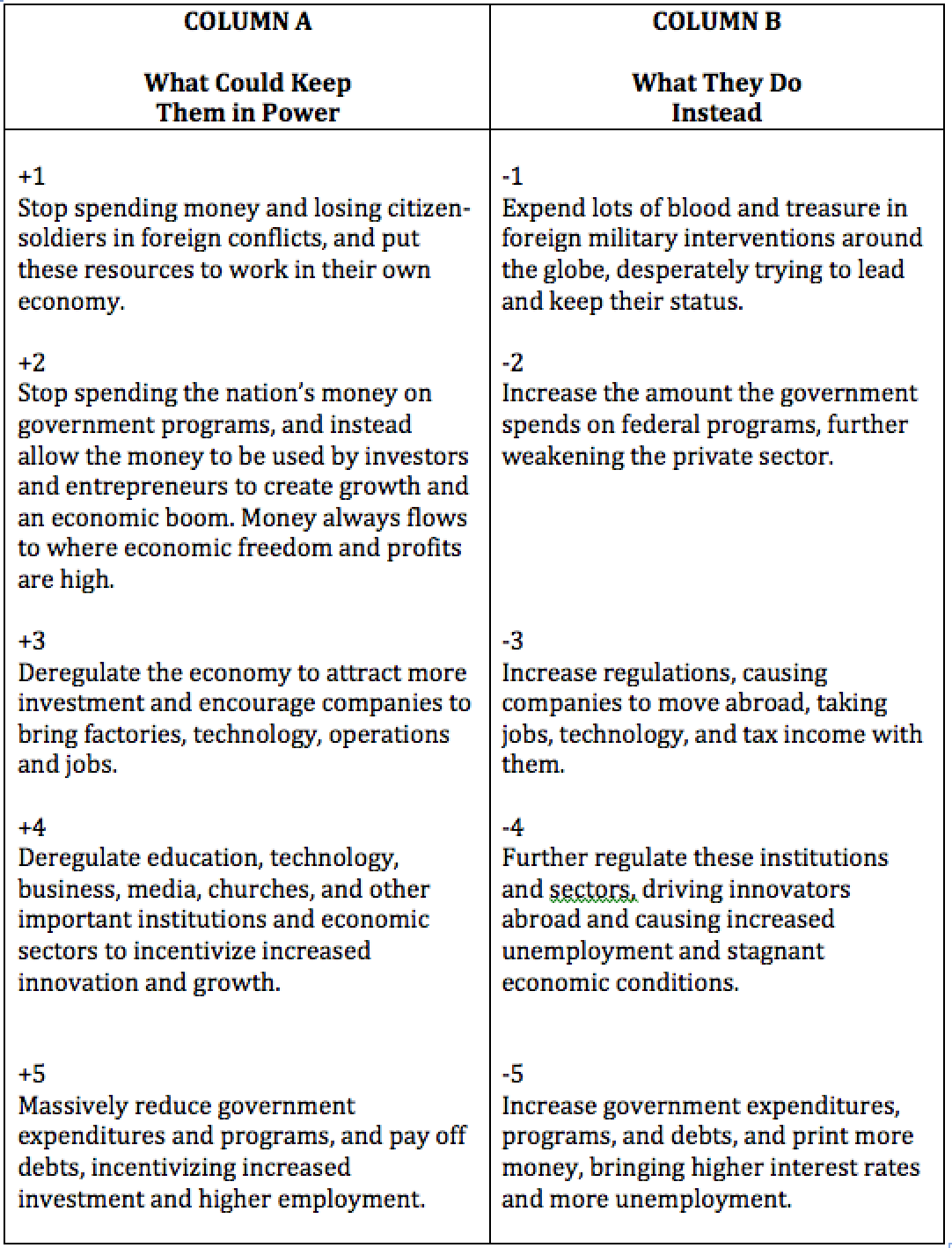

How do we get a boom? Again, the answer is simple. I’ll outline it below in Column A.

But first, what happens if we don’t make the choices that will bring a boom? The answer is clear. And drastic. Our economics will rapidly get worse. For the nation, for families, for almost everyone.

Part II

Second, China just surpassed the United States as the top producing economy in the world. It was already the top trade economy, as of a year ago. How does this translate into real life consequences for real people? Well, such a transition has happened before, and there is a predictable pattern that occurs when a new nation becomes the largest global economy.

Here is a rough outline of this pattern:

- The new power (e.g. China) has the ability to dictate its own trade rules, which increases the flow of wealth to it—and away from the old power (e.g. the U.S.).

- The new power’s currency eventually becomes the lead world currency (replacing the old power’s currency). When Britain lost it’s top power spot, the average British citizen lost 30% of net worth within weeks. In the current shift, the Chinese will likely push for a global currency. (More on this in Part III)

- The old power keeps trying to regain its status by engaging in wars and military interventions around the globe, while the new power focuses mainly on economic success. This further weakens the old power, and quickly.

- The new power, with its booming economy, is able to enjoy lower interest rates, less debt, fewer expenses for international conflicts, and much higher rates of savings and investment. The wealth of the world flows into the new power as investment capital, lifting the entire new power’s economy. The old power sees its standard of living drastically fall, while the new power watches its standard of living rapidly increase.

In the eighteenth century the old power was Spain and the new power was France, in the nineteenth century the old power was France and the new power was Britain. In the twentieth century the old power was Britain and the new power was the U.S.

Today, and in the years ahead, China is the new power, and the United States is the old power. As Brett Arends put it:

“This will not change anything tomorrow or next week, but it will change almost everything in the longer term. We have lived in a world dominated by the U.S. since at least 1945 and, in many ways, since the late 19th century.

“And we have lived for 200 years—since the Battle of Waterloo in 1815—in a world dominated by two reasonably democratic, constitutional countries in Great Britain and the U.S.A. For all their flaws, the two countries have been in the vanguard worldwide of civil liberties, democratic processes and constitutional rights.” (Brett Arends, “It’s Official: America is now No. 2,” Market Watch, December 4, 2014)

China’s influence will certainly go in a different direction. This may be the single biggest concern of our century.

Can we do anything to reverse this trend? The answer is “Yes.”

Failure by Surrender

There is an irony to how old powers lose their leadership role. The old power usually has the ability to stay the top leader, if it chooses. But is seldom does. Why? The answer is instructive.

Old powers refuse to maintain their leader role because they make a series of bad choices:

Both Are…

This is so predictable that following the pattern of decline again in our time is ridiculous. The U.S. continues to follow this path, however. Part of this is spurred by collectivist ideological ideas, but the ultimate blame goes to voters who aren’t willing to back candidates who support truly frugal economic choices to cut government programs and incentivize a free-enterprise economic boom (Column A).

Voters in traditionally powerful nations are accustomed to lavish government programs; they vocally decry government debt, but they vote for more government programs anyway. Conservatives and liberals disagree about what to spend money on, but they both increase the size of government.

One problem is that people from both sides of the political aisle blame the other. Liberals fault conservatives for supporting continued military interventions around the world, and conservatives blame liberals for increased government programs and spending.

The truth is that both are right. Liberals adopt Column B government spending and bad anti-business regulations, and conservatives support Column B global military interventions around the world. Both kill the power and economy of the nation. In our day, both of these drastically decrease American prosperity and power and lift China to global leadership.

In simplest terms: Both are bad. But Republican voters hold on to their support of U.S. interventions in Europe, Africa, the Middle East, Asia, etc., and Democratic voters refuse to stop promoting big-spending federal programs. In our two-party system, both parties are deeply committed to Column B, though for different reasons.

If the United States keeps following this pattern, our looming crash is inevitable. If not, if we reverse it and move toward an economic boom (by adopting Column A), we’ll reboot and reestablish the top producing economy in the world.

It’s up to us. Boom or crash. The choice seems simple, yet voters keep electing leaders who implement Column B rather than Column A. If we keep it up, we’re going to get what we deserve. A crash.

In all this, the most amazing thing is how simple it would be to create a boom. Column A is direct, do-able, realistic, real. We just have to adopt it, and apply it. But if we won’t even vote for it, it won’t come.

Part III

Third, changes in the world’s currency system are gaining momentum. Few Americans realize how significant these two changes ($18 trillion in federal debt and counting, and the loss of the “#1 producing economy” status to China) will be. For example, just consider the impact of the dollar being replaced by something else as the world’s reserve currency.

While most people prefer to leave currency discussions to the experts, such head-in-the-sand behavior can’t shield them from the consequences. The next reserve currency will be the dollar, if only the U.S. adopts the items in Column A and catalyzes a major American economic boom.

If not, it will be something supported by China. Specifically, look for it to have three characteristics that will drastically restructure the entire world:

- It will likely be a global currency, meaning that the international community (with China in the #1 spot) will regulate its use. This could easily result in a drastic reduction of national sovereignty around the world and in the U.S.

- It will almost surely be electronic, which will give governments massive controls over people. This amounts to at least some controls from China, not just your national government. The power of regulating electronic currency is almost impossible to overstate.

- It will also likely be sold with biotech, meaning that to access your electronic money you’ll need your finger print or eye scan. (See Molly Wood, “Augmenting Your Password-Protected World,” The New York Times, November 5, 2014) This will provide global surveillance at an unprecedented, literally more than Orwellian, level. Again, China will be a top influence (perhaps the top influence) in how this system is administered.

These three massive shifts in our world reality are mostly hidden from our view. They are reported, but few people realize how significant or personally relevant they are.

The future of our nation, our economy, and literally our society (with its God-based ideals, freedom-based values, and free enterprise economics) are at stake. If Column B prevails, an American Crash is assured.

(Oliver DeMille addresses the solutions to these challenges in his book, The United States Constitution and the 196 Principles of Freedom, available here)

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Business &Citizenship &Community &Constitution &Culture &Current Events &Economics &Education &Entrepreneurship &Featured &Generations &Government &History &Leadership &Liberty &Mini-Factories &Mission &Politics &Statesmanship

Robert Burton

10 years ago

Oliver,

Hello from an old friend. Your article, “America’s Looming Crash: Special Report,” insists that in regards to American debt, “We have to pay it, now or later.” I question this assumption. To me, history would show that a more likely scenario is one where the American government defaults on debt, mandates absolution of indebtedness and/or creates a new currency. Argentina is a recent example. I doubt that American creditors (including Americans and their companies that buy American debt) seriously consider the possibility of Americans paying back the entire debt. Rather, they see U.S. debt as an investment with varying degrees of longevity (some invest for the short-term, others mid-term). To me, default, restructuring, or dismissal of indebtedness are far more likely scenarios than actually paying the debt back, one generation at a time.

When a default occurs, the terms of restructuring are set by whoever is more powerful: the debtor or the creditor. If Greece were to default, the International Monetary Fund or World Bank would offer loans and set the terms – they would be in control. If the world’s most powerful military defaults on its debt, creditors (especially its own people) would likely be out of luck.

I do not argue that this is the best or the right answer to American indebtedness. I just think it’s the most likely.

I wonder a) whether you agree with my proposition and b) what implications this would have for your other points.

Best,

Robert Burton

Ben M

10 years ago

China, under the governing control of communism, has achieved the status of being the world economic leader in real terms (shear magnitude of economies of scale through manpower, production and output) is one thing, but I think it is unsustainable without equally dramatic and difficult changes in China no less difficult than those outlined for the U.S. in this article. China’s economic preeminence is incongruous with the idea that economic success and growth must be established on principles of freedom to be sustainable. How can a non-freedom loving, censoring, politically constraining environment either endure or sustain an environment of economic enterprise and success? Aren’t the two ideas at odds, such that over time, only one can prevail at the expense of the health of the other? Good news if economics achieves a revolutionary era of freedom with a new political governmental regime in China. But if not, won’t this economic primacy be a passing illusion for China as its political environment undermines the very foundations of their economic success?

Hardie Blake jr

10 years ago

No comment just a question: Looking for an example.

Where else has your solution worked before? What country, nation or world leader has followed your solution and succeeded?

Oliver DeMille

10 years ago

Hardie: The U.S. between 1870 and 1945, at which point – with 6% of the world’s population, it was producing over half of the world’s goods and services.

Oliver DeMille

10 years ago

Hardie: The U.S. between 1870 and 1945, at which point – with 6% of the world’s population, it was producing over half of the world’s goods and services. The reality is that almost all of the nations listed that became top powers did so by applying at least part of these solutions. Nobody became a top power doing the things in Column B, and everyone who’s done Column B has declined. The only path to Top Power is to follow, at least to some extent, the path outlined in Column A.

Bill Peavoy

10 years ago

Thank you for all 3 parts at once. The suspense would have killed me. Thank you also for the optimism in the face of such a reality. Either way it seems we would all be wise to learn some Mandarin (or even better, just read your 196 Principles). Is there an article you would recommend where a person could get a better picture of what Chinese influenced ideals, values and economics might look like?

A few months ago I had the opportunity to be in a room of Canadian politicians welcoming the newly appointed Alberta premier, Jim Prentice. Among his speaking points, he remarked that as goes Alberta, so goes the economy of Canada (something obvious to everyone in the room), but then he pointed out that Alberta was too heavily dependent on our trade partnership with the U.S. and unless we were successful in opening new trade agreements with the Pacific Rim (specifically China) we only had “about 18 months before we go down with the sinking ship” (not sure where he was getting his time reference). Looking around the room I saw a lot of nodding heads including the very influential Mayors of both Calgary and Edmonton.

Like it or not, that is how the rest of the world sees America… as unsinkable as the Titanic. It will take a lot of sacrifice and public virtue to patch the gaping holes in our hull (to say nothing about the necessity to right our rudder).

Oliver DeMille

10 years ago

Ben, China has chosen a different path than Russia. The old USSR adopted centralized economic control with centralized political control. China has adopted centralized political control, but with Market economics. Are the 2 incompatible? Ultimately, yes. But so is America’s market economics with massive regulations and constitutional government with massive regulations. If the U.S. were operating at Constitutional levels of freedom, China wouldn’t have a chance. But with the U.S. lagging somewhere around 60% freedom and China at 10% political freedom but around 70 or 80% economic freedom – yes, I think China can very much compete. The higher economic freedom will bring in lots of foreign capital, band it will incentivize many Chinese to be entrepreneurial. China’s political repression will undermine their economic success. But the U.S. economic regulation level and debt are a comparable drag. And the U.S. problem targets the entrepreneurial class above all, while the Chinese model currently hurts most people but incentivizes the entrepreneurial class. That’s huge!

Oliver

Oliver DeMille

10 years ago

Robert, great to hear from you! I agree that Washington could just default – probably by adopting a new electronic currency and just writing off the debt. That’s realpolitik. The problem is that even in this scenario, we’ll still “pay for it.” U.S. creditors will pay for it by not being paid back, and the financial ripples of such a default. U. S. businesses, banks, and consumers will pay for it by the consequences of default – foreign creditors will not lend to the U.S., or, if they do, it will be at exorbitant interest rates. Anyone who owes money will likely have to pay it off immediately – depending on their contracts – and this includes businesses. High layoffs, high unemployment, increased private-sector defaults, impossibility of getting loans – and thus more layoffs and defaults. The technical default will be paid for in real terms/wealth/assets as the market adjusts. This is “paying for it” the hard way. I hope it doesn’t go that way.

Oliver

Oliver DeMille

10 years ago

Bill, See Henry Kissinger’s book On China. More than an article, and excellent.

Oliver