Property and Freedom

June 23rd, 2011 // 11:38 am @ Oliver DeMille

We can learn a lot about freedom by understanding how Marx wanted to establish communism. One of his ten planks of establishing communism was this:

1. Abolition of property in land and application of all rents of land to public purposes…

Take away property and you take away freedom. If a man or woman cannot own land, a house, his or her own things, freedom is gone.

Note that there is more than one way to abolish property and ownership. One is to make it illegal, to not allow ownership. This is extreme, of course.

But there are other ways that are less obvious.

For example, what if it is legal to own property but only those who can afford a license, taxes, filings and attorneys to implement these things can actually own land.

This is an “abolishment,” but it is of the right rather than the left. To the person who can’t own the house, the land, or the car, however, the reality is the same.

Another way to abolish land or house ownership is simply to establish a legal-economic system where the majority cannot afford such ownership without advanced education and/or the careers which require such education.

Another is to disallow immigration so that the poor of other nations have no change to come to your nation and benefit from a system that allows ownership.

The left can abolish property ownership simply by taxing at rates that keep those with money from investing in real estate development and keep those with little money from seeking ownership.

There are many other ways to in effect abolish property ownership. Any of them hurt freedom.

Whatever your politics, it is important to evaluate each policy to ensure that you are not unknowingly supporting a Marxian reduction of freedom.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Culture &Economics &Family &Featured &Prosperity

A New Call for Free Enterprise

June 22nd, 2011 // 1:13 pm @ Oliver DeMille

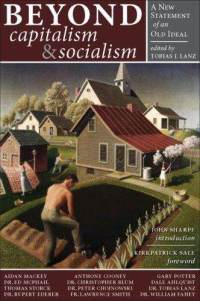

A review of Beyond Capitalism and Socialism: A New Statement of an Old Ideal, edited by Tobias J. Lanz

The message of this excellent book, Beyond Capitalism and Socialism, is straightforward and timely: both socialism and capitalism are lacking. But the book goes a step further, offering suggestions for what type of economy and society we should adopt in the twenty-first century:

“There must be a better way. And, of course, there is, and has been for a very long time. It is a society based on small self-sufficient regions, empowered communities, vibrant neighborhoods, gainfully employed families, individual self-satisfactions, decentralized politics, local economies, sustainable organic agriculture, cooperative work, environmental humility, and careful nurturing of the earth.”

The entire book outlines these basic ideals in a realistic and real-world, even anti-utopian, way.

First, it notes that through history humankind has faced on ongoing series of major crises. These are simply the reality of history. Every generation faces challenges, and some are bigger than others. We have enjoyed a period of relative peace and prosperity which is rare in human history. Crises of some kind will come, and at some point they will challenge or end the ability of big government to solve the world’s problems.

Second, the book argues that truly sustainable society depends on something more than dependence on big institutions:

“As James Kunstler puts it in The Long Emergency, when these [inevitable] crises hit, national and supranational economies will disintegrate and ‘the focus of society will have to return to the town or small city and its surrounding agricultural hinterland…’”

“’It will require us to downscale and rescale virtually everything we do and how we do it…’”

“’Anything organized on the large scale, whether it is government or a corporate business enterprise such as Wal-Mart, will wither as the cheap energy props that support bigness fall away.’”

This is an extremely important point. Towns and cities along with families could, and indeed should, at some point become once again the central institutions of human society. As a society, we have given far too little thought to this eventuality.

Third, if any or all of these changes—or others like them—occur, we will see our world drastically altered. Unfortunately, little of our modern schooling, scholarship, career training or leadership preparation is geared in any way to dealing with such a possibility.

“And then, of necessity, the world will reconstruct itself on the lines of a more human-scale, community-based, local-resource-dependent societies…”

I don’t know if this forecast will come as predicted here, but it certainly could. And if it does, we need leaders who are prepared. In fact, even if this prediction doesn’t occur, such an increase of leadership on local levels could only help our society. Even if our major institutions remain big, even global, strong local leadership is vital to success—economically, politically and on a societal level.

A Breakdown of Local Leadership

In fact, it is the breakdown of exactly this kind of local leadership, I believe, which has caused such drastic growth of institutions that are too big and such widespread dependence on these institutions. Any organization that is too big to fail is, put simply, too big. Period. If it is too big to fail, its failure is a major threat—because all man-made institutions eventually fail. Most do so earlier rather than later.

The authors of Beyond Capitalism and Socialism get it right that the answer to our major current problems are rooted in our citizens and community, and that until we build strong local foundations across society we can only expect to witness further economic decay. They are also correct that neither capitalism nor socialism hold the answers, that a return to true free enterprise is essential, and that we must get started in this process rather than wait for some crisis to force such changes.

At times the authors get caught up in denominational debates from the Catholic perspective, but this tends to deepen the benefit of the book rather than detract. Readers do not have to buy into any religious themes to learn from the numerous commentaries on the potential of free enterprise society.

The book is invaluable reading for American, and all freedom-loving, citizens. As one of the authors wrote:

“Given a society, in which men, or the vast majority of men, owned property and were secure in their income, the myriad interactions of free men making empowered choices really would balance supply and demand. We would be astonished at the variety, the non-servility, and the creativity of our neighbors.”

I am convinced that this is both true and, especially in our modern world, profound. Still, I found the book lacking in one major detail. I prefer the term “free enterprise” to “Distributive,” first because I think it more accurately describes the philosophy for which it stands and second because I’m not convinced that free enterprise and distributism are precisely the same thing. They share many ideals, it is true, but there are differences.

For example, both free enterprise and distributism agree that:

- neither capitalism nor socialism is the ideal

- capitalism, in which those with wealth are treated differently by the law than those without wealth and the level of one’s wealth determines which laws pertain to each person, is flawed

- socialism, in which the government owns the major means of production and levels incomes and work assignments in an attempt to create long-term equity between all citizens and where one’s status is determined by one’s government position, is flawed

- the local society, economy and government is more important than the state- or national-level economy and government and should be treated as such

- families are the central institution of society, and they are more important than markets or governments; markets and governments exist to help families, not vice versa

- money is an important consideration in making choices for family, career, business and society, but it is less of a priority than relationships, spirituality and morality

- we have reached a point in the modern world where our societal dependence on big institutions—both government and corporate—is a serious weakness in our culture and causes much that is negative in our world

- a return to society that is more ideal, more locally-oriented, and citizens that are more independent and entrepreneurial is overdue. In such a society, most families would own their own businesses rather than remaining dependent on government or corporations for their jobs and livelihoods

Free Enterprise and Distributism

The big difference between free enterprise and distributive thought hinges on how we should move toward such a society. Dale Ahlquist, one of the authors in Beyond Capitalism and Socialism, suggested the following:

“The dilemma of Distributism is the dilemma of freedom itself. Distributism cannot be done to the people, but only by the people. It is not a system that can be imposed from above; it can only spring up from below….If it happens, it seems most likely that it would be ushered in by a popular revolution. In any case, it must be popular. It would at some point require those with massive and inordinate wealth to give it up.”

The desire for popular support is normal for all political groups, but the idea that Distributism “would at some point require those with massive and inordinate wealth to give it up” is alarming at best. Why would the wealthy have to “give it up?” Why is that necessary in free society? The word “required” is the problem. Fortunately, Ahlquist clarifies that this would be voluntary, so it isn’t Marxist, but it still makes me wonder, Why?

Nor is this the isolated view of just one author. Here is how another of the authors put it (and for this author voluntarism is replaced by government force):

“For instance, if I own one or several stores (say pizza restaurants) I would have a reasonable and normal rate of taxation, but as soon as I begin to assemble a chain of such businesses, then my rate of taxation would rise so sharply that no one of a normal disposition would seek to continue to own such a chain….A similar scheme of taxation would attack ‘multiple shops,’ that is, stores selling many lines of goods, such as a mega or ‘box’ stores, and stores with ‘large retail power.’”

Again, the obvious question is, why? The answer is that no big institutions can be allowed, that everything must by force remain small. This makes the same mistake as Marx, who taught that government would take from the rich and redistribute equally to all. The mistake was to think that those running the government wouldn’t keep a little (or a lot) extra for themselves and their families. In the Distributive ideal, where no institution can be allowed to be too big, the clear flaw is that any institution powerful enough to keep all the others small will have to be, well, big.

That means big government. The Distributists would presumably want the government to be local, but strong enough to keep all the other institutions small. The American founders already dealt with this and wrote about it extensively in the Federalist Papers. Madison, for example, said that nearly all of the colonies in the late 1780s suffered from local governments that were too dominant—they nearly all had corrupt and anti-freedom practices. This was one of the strongest arguments in support of the U.S. Constitution: a central entity would help reduce oppressive, intrusive and unfair governing fads which always arise in small (and therefore inbred) governments.

Clearly government has become much too big today, but a return to locales dominated by a few powerful families that ignore the needs of the rest of the people is not the answer—though it is precisely what would happen to most local governments if left to themselves. History is clear on this point.

We certainly need more local leadership, independence and a lot more entrepreneurialism and real ownership. We need good local government to make it work, and ideally a federation of local governments to maintain real freedom.

Is Taxation the Answer?

But back to the main point: Why would we want to use government taxation to keep any business from growing? If it offers a good product at a good price and people prefer its offering to those of other businesses, why should we drastically increase its taxes so that it remains small? Is smallness the central point? If so, this is the reason I prefer free enterprise. One more quote will suffice to further my point:

“Of course, a suitable period of time would be necessary to complete an orderly sell-off of property from excessively large owners to small owners before the new tax system came into full effect. Moreover, if this is instituted at a very reasonable pace, with tax rates on concentrations of property increasing gradually each year, this would give owners more time to prepare and help prevent a ‘firesale’ of their property. Similarly some form of guaranteed loans would have to exist to allow those without property or money to purchase the excess property that was being sold.”

My first thought when I read this was, “Who gets to determine what ‘excess’ means in such a society? Whoever it is, they’ll eventually keep more of the money and power than everyone else.” This one flaw in how the book describes Distributism is a serious problem. It proposes stopping one capitalist from getting too much wealth and power, but it doesn’t seem to realize that it also proposes taking the “excess” money from the capitalist and giving it to the socialist.

In contrast, free enterprise takes a different route. It establishes good laws that treat the rich, middle and poor the same. Period. That is freedom.

Is the U.S. a Free-Enterprise Economy?

Some people may believe that this is the system we live under in the United States today. Such an assumption is incorrect. The U.S. commercial code has numerous laws which are written specifically to treat people differently based on their wealth.

For example, it is illegal for those with less than a certain amount of wealth to be offered many of the best investment opportunities. Only those with a high net worth (the amount is set by law) are able to invest in such offerings. This naturally benefits the wealthy to the detriment of wage earners. This system is called capitalism, and it is a bad system—better than socialism or communism, to be sure, but not nearly as good as free enterprise.

In a free enterprise system, the law would allow all people to take part in any investments. The law would be the same for all. If this seems abstract, try starting a business in your local area. In fact, start two. Let the local zoning commissions, city council and other regulating agencies know that you are starting a business, that it will employ you and two employees, and then keep track of what fees you must pay and how many hoops you must jump through. Have your agent announce to the same agencies that a separate company, a big corporation, is bringing in a large enterprise that will employ 4,000 people—all of whom will pay taxes to the local area and bring growth and prestige.

Then simply sit back and watch how the two businesses are treated. In most places in the United States, one will face an amazing amount of red tape, meetings, filings and obstacles—the other will likely be courted and given waivers, benefits and publicity. Add up the cost to government of each, and two things will likely surprise you: 1) how much you will have to spend to set up a small business, and 2) how much the government will be willing to spend to court the large business.

This is the natural model in a capitalist system. Capital gets special benefits. Apparently, in contrast, in Distributist society the small business would pay little and the big business would have to pay a lot more. Under socialism, neither business would be established at all—at least not by you. A government official would do it all, or not do it.

In free enterprise, the costs and obstacles would be identical for the two businesses. In free enterprise, the operative words are “free” and “enterprise.”

Some Distributists seem to share the socialist misconception that unless government forces smallness, every business owner will push to become too big. Wendell Berry, a favorite writer of mine, often took the same tone. In reality, however, the evidence is clear that American business and ownership stayed mostly small—with most people owning family farms or small businesses—until the 1960s. It was government debt which wiped out the farming culture that dominated the South and Midwest, and the rise of big corporations over family-owned businesses came after the U.S. commercial code was changed by law to a capitalist rather than a free-enterprise model.

Give Freedom a Try

Instead of using government to force businesses to remain small, let’s consider giving freedom a try. It has worked for us in the past. If we altered the laws at all levels so that government entities treated all businesses and citizens the same, regardless of their level of capital in the bank, the natural result would be the spread of more small businesses. Freedom, not government control, is the answer.

With all that said, I’m convinced that at least some, maybe many or most, of Distributists in general and the contributing authors to Beyond Capitalism and Socialism specifically would agree with this point, that in fact their view of Distributism coincides with free enterprise. For example, Ahlquist’s chapter appears entirely supportive of free enterprise.

Still, I am concerned by this one thread of thought among some of the authors that seems to see government as the way to keep business from growing. Free enterprise gives no special benefits to big business like capitalism does, but it also does not force businesses to remain small. If this is the view of most Distributists, I agree with them. Even if we disagree on this point (and I’m not certain that we do), I find much to praise in this excellent book.

Quotable Quotes

Beyond this one concern, I can’t say enough positive about Beyond Capitalism and Socialism. It is greatly needed by our citizens today. Everyone should read it and ponder its application to our current world. Consider the following thoughts from this thought-provoking book:

“Home and family are the normal things. Trade and politics are necessary but minor things that have been emphasized out of all proportion.” –Dale Ahlquist

“What then is Distributism? It is that economic system or arrangement in which the ownership of productive private property, as much as possible, is widespread in a nation or society. In other words, in a Distributist society most…would own small farms or workshops…” –Thomas Storck

“As Political Economy is the child of Domestic Economy, all laws that weaken the home weaken the nation.” –Joseph McNabb

“The family, not the individual, is the unit of the nation.” –Joseph McNabb

“We don’t want to work hard. We don’t want to think hard. We want other people to do both our work and our thinking for us. We call in the specialists. And we call this state of utter dependency ‘freedom.’ We think we are free simply because we seem free to move about.” –Dale Ahlquist

“The conservatives and liberals have successfully reduced meaningful debate to name-calling. We use catchwords as a substitute for thinking. We know things only by their labels, and we have ‘not only no comprehension but no curiosity touching their substance or what they are made of.’” –Dale Ahlquist

“The real purpose of traveling is to return. The true destination of every journey is home.” –Dale Ahlquist

“[T]oday here in the United States of America, and in all industrialized countries…there is a class of men and women, perhaps the majority, that…is unfree….I mean, all those who subsist on a wage, the price paid for the commodity they have and who have no other means of maintenance for themselves and their families. I mean…all those who subsist on a wage that is paid to them by those who are, in actuality, their masters; a wage that may be withdrawn at any time and for any reason, leaving them on the dole, or to starve, if they can find no new job…These are not free men in any rational and exact sense of the word.” –Ralph Adams Cram

“Every man should have his own piece of property, a place to build his own home, to raise his family, to do all the important things from birth to death: eating, singing, celebrating, reading, writing, arguing, story-telling, laughing, crying, praying. The home is above all a sanctuary of creativity. Creativity is our most Godlike quality. We not only make things, we make things in our own image. The family is one of those things. But so is the picture on the wall and the rug on the floor. The home is the place of complete freedom, where we may have a picnic on the roof and even drink directly from the milk carton.” –Dale Ahlquist

“The word ‘property’ has to do with what is proper. It also has to do with what is proportional. Balance has to do with harmony. Harmony has to do with beauty….The word ‘economy’ and the word ‘economics’ are based on the Greek word for house, which is oikos. The word ‘economy’ as we know it, however, has drifted completely away from that meaning. Instead of house, it has come to mean everything outside of the house. The home is the place where the important things happen. The economy is the place where the most unimportant things happen.” –Dale Ahlquist

“Caveat lector! For there is little resemblance indeed of the real ownership of real property…to the ‘rent-from-the-bank’ home ‘ownership’ (sic) of most American families.” –John Sharpe

“Our separation of economy from the house is part of a long fragmentation process….Capitalism has separated men from the home. Socialism has separated education from the home….The news and entertainment industry has separated originality and creativity from the home, rendering us into passive and malleable customers rather than active citizens.” –Dale Ahlquist

“In the age of specialization we tend to grasp only small and narrow ideas. We don’t even want to discuss a true Theory of Everything, unless it is invented by a specialist and addresses only that specialist’s ‘everything.’” –Dale Ahlquist

“In material things there can be no individual security without individual property. The independent farmer is secure. He cannot be sacked. He cannot be evicted. He cannot be bullied by landlord or employer. What he produces is his own: the means of production are his own. Similarly the independent craftsman is secure, and the independent shopkeeper.

No agreements, no laws, no mechanism of commerce, trade, or State, can give the security which ownership affords. A nation of peasants and craftsmen whose wealth is in their tools and ski and materials can laugh at employers, money merchants, and politicians. It is a nation free and fearless. The wage-earner, however sound and skilful his work, is at the mercy of the usurers who own that by which he lives.

Moreover, by his very subjection he is shut out from that training and experience which alone can fit him to be a responsible citizen. His servile condition calls for little discretion, caution, judgment, or knowledge of mankind. The so-called ‘failure of democracy’ is but the recognition of the fact that a nation of employees cannot govern itself.” –John Sharpe

Whether you agree or disagree with the details, this book is a treasure of great ideas to consider, discuss, ponder and think about. We need this book today, and we need a society that has read it and deeply contemplated its numerous profound concepts.

Whether or not the ideas in Beyond Capitalism and Socialism become necessary to all of us through some major crisis ahead, a national consideration of these topics is long overdue. We do need to move beyond capitalism and socialism. We need a rebirth of free enterprise, for our nation, economy, freedom, prosperity and above all, for our families and communities.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Book Reviews &Economics &Entrepreneurship &Featured &Government &Liberty &Mini-Factories &Producers &Prosperity &Tribes

Egypt, Freedom, & the Cycles of History

February 14th, 2011 // 12:31 pm @ Oliver DeMille

*Note: If you like this article, you’ll love Oliver’s latest book, FreedomShift: 3 Choices to Reclaim America’s Destiny.

I look at the young protesters who gathered in downtown Amman today, and the thousands who gathered in Egypt and Tunis, and my heart aches for them. So much human potential, but they have no idea how far behind they are—or maybe they do and that’s why they’re revolting.

“Egypt’s government has wasted the last 30 years—i.e., their whole lives—plying them with the soft bigotry of low expectations: ‘Be patient. Egypt moves at its own pace, like the Nile.’ Well, great. Singapore also moves at its own pace, like the Internet.” —Thomas L. Freidman

A World of Demonstrations

In the fall of 2010 I listened to a famous French author speaking as a guest on a television talk show. He expressed concern with the Tea Party in the United States and wondered how democracy could survive “such a thing.”

A few weeks later his own nation was shut down by rioting protestors—middle class managers and professionals burning cars in the streets and throwing homemade pop bottle firebombs.

I wondered if he had revised his worries about what he called Tea Party “extremism.” In the U.S. the peaceful demonstrations were much more civil and positive (and, as it turns out, effective) than their French counterparts.

In the last year we’ve witnessed demonstrations, protests, and even a few violent riots across the globe—from Greece to Ireland, Paris to Washington, Iran to Cairo, and beyond. It is interesting to see how the left and right in the U.S. have responded.

The left welcomed demonstrations against governments that were run by the privileged class in Iran, Greece, Ireland, Egypt, China and even France. Instead of feeling threatened by such uprisings, they tended to see them as the noble voice of humanity yearning for freedom from oppression.

In contrast, they saw marches and demonstrations from the American right as somehow dangerous to democracy. In such a view, protests are owned by the left and those on the right aren’t allowed to use such techniques—they are supposed to better behaved.

In contrast, the right tended to view recent right-leaning town meetings and D.C. demonstrations in the United States as progressive, while viewing the French, Irish, Greek and Middle East protests with critical eyes.

The old meaning of “conservative” was to simply want things to stay the same, and in world affairs many American conservatives seem to prove this definition.

An uprising in Iran or Egypt, as much as one might identify with the people’s desire for freedom, feels threatening and disturbing to many on the right.

The Cycles

The demonstrations and the diverse ways of viewing them is a natural result of a major shift we are experiencing in the world. Strauss and Howe called it “The Fourth Turning,” a great cyclical shift from an age of long-term peace and prosperity to a time of challenge and on-going crises.

We have experienced many such shifts in history (e.g. the American revolutionary era, the Civil War period, the era of Great Depression and World War II), but that doesn’t soften the blow of experiencing it firsthand in our generation.

Following the cycles of history, we have lived through the great catalyst (9/11) which brought on the new era of challenge, just like earlier generations faced their catalytic events (e.g. the Boston Tea Party, the election of Abraham Lincoln, or the Stock Market crash of 1929).

We are now living in a period of high stress and high conflict, just as our forefathers did in the tense periods of the 1770s, 1850s and 1930s. If the cycles hold true in our time, we can next expect some truly major crisis—the last three being the attack on Pearl Harbor, the first shots of the Civil War, and the fighting at Lexington and Concord.

These realities are part of our genetic and psychic history, even if we haven’t personally researched the trends and history books. We seem to “know” that challenges are ahead, and so we worry about the latest world and national news event.

“Will this ignite the fire?” “Will this change everything?” “Is this it—the start of major crisis?” Conservatives, liberals, independents—we nearly all ask these questions, if only subconsciously.

Conservatives tend to believe that major crisis will come from the “mismanagement of the left,” while liberals are inclined to think the problems will be caused by the extremism of the right.

Independents have a tendency to feel that our challenges will come from both Republicans and Democrats—either working together in the wrong ways or getting distracted from critical issues while fighting each other at precisely the wrong time.

Add to this strain the fact that we are simultaneously shifting from the industrial to the information age, and it becomes understandable that the pressure is building in many places in today’s world.

The shift from the agricultural age to the industrial age brought the Civil War, Bismarck’s Wars (known to many in Europe as the first great war—a generation before World War I), and the Asian upheaval as it shifted from the age of warlords to modern empires.

Today we have mostly forgotten how drastic such a change was, and how traumatically it impacted the world.

The Egypt Crisis

The bad news is: if the cycles and trends of history hold, we will likely relive such world-changing events in the decades ahead. As for Egypt, our reactions are telling us more about ourselves than about the Arab world.

Knee-jerk liberalism thrills at another people rising up against authoritarianism but worries that the extreme religious nature of some of the militants will bring the wrong outcomes.

Knee-jerk conservatism reinforces its view that the middle east is the world’s problem area, that we should just get out of that region (or get a lot more involved), and that stability is more important than things like freedom and opportunity for the Egyptian people.

Deep thinkers from all political views see that we now live in the age of demonstrations. The worldwide shift from decades of relative peace and prosperity to a time of recurring crises is putting pressure on people everywhere.

Some protest the reduction of government pensions and programs as nations try to figure out how to get their financial houses in order. Others demonstrate against governments that respond to major economic crises with increased spending, stimulus and government programs.

Still others riot against authoritarian governments that haven’t allowed the people a true democratic voice in the direction of their nation or society.

When we shift from an industrial era of peace and prosperity to an information-age epoch of crisis and challenge, people in all walks of life feel the pressure and anxiety of change. This manifests itself in relationship, organizational, financial and family stress, as well as cultural, class, religious, political and societal tensions. We are witnessing all of these in this generation.

Egypt may spark a major world crisis, and indeed many feel that the Egyptian challenge is the biggest foreign policy crisis of Obama’s presidency. As Thomas L. Friedman put it, on a more global scale:

“There is a huge storm coming, Israel. Get out of the way.”

President Bush’s supporters are using Egypt to bolster the view that Bush’s attempts to establish democracy in the Arab world was wise foresight, and Obama supporters hope that a re-democratized Egypt can stand as “beacon to the region.”

If the Egyptian uprising becomes the start of pan-Arabism led by the Muslim Brotherhood (or something like it), this will certainly bring significant changes to the Middle East and to international relations across the board.

On the other hand, a similar outcome could result from a totalitarian crackdown that extinguishes the will of the Egyptian people to fight for legitimate reform. The most likely result may be what has happened more often recently: the replacement of authoritarian government with a powerful oligarchy ruling the nation.

The American Crisis

How the United States responds to any of these scenarios, or whatever else may happen, will have a significant impact on world policy.

Add to this at least two concerns: Serious inflation is already a growing reality and increasing danger, and many are watching to see the impact on the price of oil on our economy.

If the cost of gasoline goes above $5 or $6 or, say, $9 per gallon in the U.S., what will happen to 9.6% unemployment, state and local governments that are already close to bankruptcy, and a reeling economy just barely emerging from the Great Recession?

If the Egypt Crisis doesn’t ignite a major world or American crisis, something else will. That’s the reality of our place in the cycles of history. Challenges are ahead for our nation.

This is true in any generation, but it is even more pronounced in the generations where we shift from an era of peace and prosperity to an epoch of crisis and challenge. As we also move into the information age, we have our work cut out for us.

Futurist Alvin Toffler wrote:

“A new civilization is emerging in our lives. This new civilization brings with it new family styles; changed ways of working, loving and living; a new economy; new political conflicts. Millions are already attuning their lives to the rhythms of tomorrow. Others, terrified of the future, are engaged in a desperate, futile flight into the past and are trying to restore the dying world that gave them birth. The dawn of this new civilization is the single most explosive fact of our lifetimes. It is the central event—the key to understanding the years immediately ahead.”

The good news is that in such times of challenge we have the opportunity to significantly improve the world in important ways.

The Revolutionary era brought us the Constitution and the implementation of free enterprise and a classless society, the Civil War ended slavery, and the World War II era brought us into the industrial age with increasing opportunity for social equity and individual prosperity.

Freedom, free enterprise, increased caring and more widespread economic opportunities are likely ahead if we as a society refocus on the principles that work. Liberals, conservatives and independents have a lot to teach each other in this process, and we all have a lot to learn.

The biggest danger is that the age of demonstrations will lead to an age of dominance by elites—in Egypt, in Europe, in Asia, and in North America. Unfortunately, popular demonstrations are most often followed by the increased power of one elite group or another.

Though this is the worst-case scenario, it is also a leading trend in our times. In contrast, only a society led by the people can truly be free, and only such a future can turn our challenging era into a truly better world.

Each of us must take responsibility for the future, rather than leaving the details to experts. Many citizens in Egypt are trying to do this—for good or ill.

In America, we need more regular citizens to be leaders so we can meet this generational challenge as our forefathers did theirs—leaving posterity with greater freedom and opportunity.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Current Events &Featured &Foreign Affairs &Government &History &Liberty &Politics

Why are We Still in Recession?

February 10th, 2011 // 4:39 pm @ Oliver DeMille

Why was it that scientists were so excited to discover facts that farmers had known for generations and generations?” —Brandon Sanderson, The Way of Kings

The Wisdom of Crowds or Crowns?

There is a technical definition of economic “recession,” but many Americans don’t know exactly what it is. Nor do they accept the experts’ assurances that the Great Recession is really over.

Indeed, in the view of many, it was the experts who led us into recession while predicting something else.

The same experts promised that stimulus would fix things, and now they continue to confidently promise and predict as if their record should somehow bolter our trust.

In many ways, America’s elites consider regular Americans uninformed and ignorant. But there is another kind of wisdom, not based on expertise and therefore seldom understood by the elite class (most of whom were convinced some time before or during college that erudition is a matter of credentials, titles and peer consensus).

The “other” wisdom is based on an innate or experiential understanding of principles, of knowing things like these: Increased government size and spending is out of control; and like the housing bubble, the big-government bubble will have to burst at some point.

In the governmental model as erected by the American Founders, the wisdom of the masses is a critical and even central feature of republican government.

The American founders so trusted this type of wisdom above that of experts that they put the regular citizens in charge of elections and our direct representatives in charge of the nation’s purse strings.

They also gave the federal government only 20 specific powers and left the rest to the states and people.

Many, especially the upper classes of Europe, argued that such an arrangement could not succeed, that nations must be led by elites and their specialized agents.

History proved the Founders correct in this debate.

A Second Type of Recession

There is also another kind of “recession” not defined by economists but very real nonetheless — a recession where most people feel deep and overwhelming economic anxiety, where few families have as much money now as three years ago but more expenses, and where the majority feels deep down that things will get worse before they get better.

This kind of recession doesn’t move charts or graphs, but it does operate on a real logic: When the experts are wrong over and over, stop following them.

It should be noted that the people who use this type of reasoning generally have great respect for expertise and the experts, but not a blind faith.

Such wisdom holds that if individuals, households and businesses must tighten their belts, live within their means, and rise to a more self-reliant and entrepreneurial approach now that times are hard, the government needs to do the same.

If Washington refuses such common sense, it is deluding itself — and forcing us to pay the bill.

This “other” wisdom realizes that we have lived beyond our means for some time, and that we can only really build a new model if the old system is deeply changed.

The far Right and far Left argue that such progress can only come from the ashes or ruins of our broken system “after it falls,” while more moderate voices believe that a few fundamental shifts in worldview and policy can get us back on track.

We can move from nanny state to free enterprise, according to this view, from big government to smaller and more effective government, from a nation of dependents to a nation of innovators.

Such arguments sometimes sound untrained and unsophisticated to elite ears, partly because the privileged class wants America to look good to the European eye — but mainly because these type of arguments are often untrained and unsophisticated.

But we should not make the mistake of considering them naïve or ineffectual.

Sometimes the simple solution is best — especially when one of the most daunting problems is how complex our government and economy have become.

Expecting any single expert or government official to have a full grasp of it all is truly unrealistic, and depending on large teams of specialized experts doesn’t work without leadership from those who grasp the entire reality and envision something better.

Citizen Leadership

Grassroots wisdom from the people as a mass accomplishes this more effectively than any party, politician or intellectual class. This is the linchpin of freedom. The citizens must truly lead, or freedom does not last.

In times of crisis, wisdom is more important than expertise. Both are essential, but wisdom is most vital.

The American people, however uninformed they may appear to elite tastes, have wisdom in spades. They make mistakes, as Jefferson and later Tocqueville put it, but they always correct them.

In the governmental model as erected by the American Founders, the wisdom of the masses is a critical and even central feature of republican government.

One central reality stands out right now: People are struggling a lot more than the experts admit or the numbers show.

The economy may be in a slow recovery, but the American people are stuck in recession. And they know it.

Families and communities are experiencing more hurt than gets reported, and many people feel that things are getting worse. The middle-class standard of living is collapsing, and the worst of the housing bubble appears to still be ahead. Moreover, the government bubble is real and eventually it will burst.

Unemployment is worse than the numbers show. For example, many of the job losses are in middle- and high-paying jobs while most new jobs are low-paying. With the real unemployment rate (which includes those who have given up even trying to find a job) over 12 percent and the underemployed rate above 18 percent, we are more than halfway to a depression (traditionally defined by 25 percent unemployment).

Yet our leaders spend, borrow, and spend. The Chinese have continued to lend us more, as we figuratively hung ourselves and our posterity with an unyielding cord of debt.

Washington regulates more roadblocks to business growth, and tells us that 10 percent unemployment is the new normal. Then politicians pile on more regulations that hinder global investment in the U.S. and send it to friendlier markets.

American firms go abroad and find lower taxes, reduced regulatory environments, and more plentiful capital.

As unemployment lingers in the wake of these policies, we are assured that more government programs will care for those without jobs.

Most Americans find this more alarming than comforting. Consumers don’t spend. Businesses close. A drive down Main Street, Anywhere, USA is a museum tour of boarded-up windows.

We elect one party’s leaders with high hopes, then we try the other party—back and forth, without lasting success. Things worsen. Inflation may follow, as the Fed prints more money and further devalues our currency.

Many Americans feel the afterglow right after a major election, but the anxiety returns when the bills keep coming and they try to balance their checkbooks and plan for the years ahead. Call this recovery if you want, but the American people aren’t convinced.

Next Steps

The good news is that when pushed the American people take note and take a stand. The great American entrepreneurial spirit is rising, and it is our only real hope.

Elections come and go, but cultivating the values and skills of free enterprise in ourselves and others builds for the long term. It creates a solid foundation that works.

The election of 2010 is over, and the elections of 2012, 2014, 2016 and beyond will not have near as much impact on America’s future as the entrepreneurial spirit (or the lack of it) among the mass of regular citizens.

To the extent that elections help free the economy for growth, they can greatly benefit our prosperity and freedom.

But ultimately America’s success and affluence will depend upon the initiative, innovation, creativity, tenacity, resiliency, ingenuity, enterprise and entrepreneurial spirit of the regular people.

This is the true wisdom of crowds, and only the regular people can make this happen.

China may rise in prominence and even to superpower status in the decades ahead. If so, it will do so by applying these very entrepreneurial traits. The same is true of India, Brazil, Europe, other places, and the United States.

Our future depends on the rise of these entrepreneurial values and characteristics. The adoption of these will signal a true economic Recovery and put a real end to the Great Recession.

Whatever the politicians, parties and experts say, the world of 2020, 2030 and 2040 will be a world of our making, and the nations which rise in prosperity, freedom and power will be those where the entrepreneurial spirit flourishes.

With this in mind, I am convinced of at least two things: Our future is bright, and there is a lot of work ahead for all of us.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Business &Economics &Entrepreneurship &Featured &Government

Redcoats to the Rescue!

January 12th, 2011 // 11:06 am @ Oliver DeMille

Republicans and Democrats have increased government spending for years. Bush’s budget was drastically higher than Clinton’s, and President Obama has continued increasing spending.

The White House blames the Bush Administration for the economic meltdown it inherited, and rightly so.

But now independents, conservatives and many working-class Americans have reached a point where they feel frustrated that the Obama Administration has not fixed the economy — indeed, many feel that a number of programs have made things worse.

Big corporations have significant cash reserves right now, but they are unwilling to spend it with the Obama Administration’s general dislike of business. Capital goes where it is treated well, and right now that’s not the United States.

In fact, many businessmen are concerned that things will get worse before they get better, that the government will continue to make war on business, increase regulation, buy up and control more of the economy, and generally harass free enterprise.

Many believe we will see a return of recession in the next few quarters, and even if we achieve double the economic growth of the 1990s (which is obviously unlikely) it would take us over two years to get back to normal levels of unemployment.

With Moody’s report on August 21, 2010 that jobless claims are rising, “the economy is weakening,” “the rate of growth is slowing” again, and “unemployment is going to rise higher,” this is even more important.

Yet Washington is increasing regulation on business, making investment and entrepreneurial ventures more difficult, and sending the message that business is not really welcome anymore in the United States.

We need a major economic boost in the worst way, and instead our leaders are showing aversion and at times even loathing for the entrepreneurial spirit that grows any free economy. What are we thinking?

The British Way

More to the point, where is the national leader that will reboot the economy? The answer is: in England.

If that’s surprising, consider the evidence. The new British government, led by David Cameron, is taking drastic action to fix Britain’s economy. This path is difficult, but it is based on the reality of the new world economy. Americans should pay close attention.

Specifically, the new English budget balances the government’s books, shrinks most government departments by a quarter, and brings down programs and costs in schools, health-care services, welfare and many other areas of spending.

The government is “handing power to parents to run the schools,” putting doctors in charge of health care, and attempting to change “a culture in which Britons have looked to government for services and answers they could provide themselves.”

The Obama and Cameron administrations both inherited a major economic mess, but they are responding in nearly opposite ways.

So here we are in 2010 with a striking scenario: Washington is drastically increasing government spending and regulating at levels that would probably impress Marx and certainly Keynes, while Britain is reducing government and incentivizing free enterprise in ways reminiscent of Hayek or Milton Friedman!

It’s the “world turned upside down” (a song played at the end of the Revolutionary War when the British found out their invincible empire had given in to the American rebels).

President Obama and his team deserve credit for making GM profitable again and for moving forward plans to sell it back to the private market. And they are making similar progress with Chrysler.

Additional burdensome regulations and taxes on business are still being proposed, however. One recent political cartoon shows President Obama standing near a dying man named “Economic Recovery” saying, “The bloodletting didn’t work. Maybe we should try some leeches.”

For many in the business community, (whether or not it’s true) the White House appears more of an enemy than a friend. The British leaders at least seem to be on the side of trying to help those who run businesses rebound and succeed.

Enterprise Needed

Of course, it remains to be seen if a nation with as much government intervention in the economy as Britain can make it work, but certainly any good news for business and enterprise is positive for the world economy.

In addition to Britain, nations including Canada, Israel, India, Brazil and even China are doing more than before to actively incentivize entrepreneurs, investors and small business.

The U.S. should take notes: Government overspending and a campaign of alienating investors and small business isn’t really the best way to boost the economy or overcome massive unemployment.

At some point, the United States will either choose to reemphasize its powerful free-enterprise roots or it will decline in world power, freedom and prosperity. Perhaps now, with the British trying to lead the way, is the right time.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Current Events &Economics &Featured &Government &Liberty &Politics