Property and Freedom

June 23rd, 2011 // 11:38 am @ Oliver DeMille

We can learn a lot about freedom by understanding how Marx wanted to establish communism. One of his ten planks of establishing communism was this:

1. Abolition of property in land and application of all rents of land to public purposes…

Take away property and you take away freedom. If a man or woman cannot own land, a house, his or her own things, freedom is gone.

Note that there is more than one way to abolish property and ownership. One is to make it illegal, to not allow ownership. This is extreme, of course.

But there are other ways that are less obvious.

For example, what if it is legal to own property but only those who can afford a license, taxes, filings and attorneys to implement these things can actually own land.

This is an “abolishment,” but it is of the right rather than the left. To the person who can’t own the house, the land, or the car, however, the reality is the same.

Another way to abolish land or house ownership is simply to establish a legal-economic system where the majority cannot afford such ownership without advanced education and/or the careers which require such education.

Another is to disallow immigration so that the poor of other nations have no change to come to your nation and benefit from a system that allows ownership.

The left can abolish property ownership simply by taxing at rates that keep those with money from investing in real estate development and keep those with little money from seeking ownership.

There are many other ways to in effect abolish property ownership. Any of them hurt freedom.

Whatever your politics, it is important to evaluate each policy to ensure that you are not unknowingly supporting a Marxian reduction of freedom.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Culture &Economics &Family &Featured &Prosperity

A New Call for Free Enterprise

June 22nd, 2011 // 1:13 pm @ Oliver DeMille

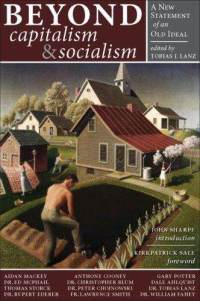

A review of Beyond Capitalism and Socialism: A New Statement of an Old Ideal, edited by Tobias J. Lanz

The message of this excellent book, Beyond Capitalism and Socialism, is straightforward and timely: both socialism and capitalism are lacking. But the book goes a step further, offering suggestions for what type of economy and society we should adopt in the twenty-first century:

“There must be a better way. And, of course, there is, and has been for a very long time. It is a society based on small self-sufficient regions, empowered communities, vibrant neighborhoods, gainfully employed families, individual self-satisfactions, decentralized politics, local economies, sustainable organic agriculture, cooperative work, environmental humility, and careful nurturing of the earth.”

The entire book outlines these basic ideals in a realistic and real-world, even anti-utopian, way.

First, it notes that through history humankind has faced on ongoing series of major crises. These are simply the reality of history. Every generation faces challenges, and some are bigger than others. We have enjoyed a period of relative peace and prosperity which is rare in human history. Crises of some kind will come, and at some point they will challenge or end the ability of big government to solve the world’s problems.

Second, the book argues that truly sustainable society depends on something more than dependence on big institutions:

“As James Kunstler puts it in The Long Emergency, when these [inevitable] crises hit, national and supranational economies will disintegrate and ‘the focus of society will have to return to the town or small city and its surrounding agricultural hinterland…’”

“’It will require us to downscale and rescale virtually everything we do and how we do it…’”

“’Anything organized on the large scale, whether it is government or a corporate business enterprise such as Wal-Mart, will wither as the cheap energy props that support bigness fall away.’”

This is an extremely important point. Towns and cities along with families could, and indeed should, at some point become once again the central institutions of human society. As a society, we have given far too little thought to this eventuality.

Third, if any or all of these changes—or others like them—occur, we will see our world drastically altered. Unfortunately, little of our modern schooling, scholarship, career training or leadership preparation is geared in any way to dealing with such a possibility.

“And then, of necessity, the world will reconstruct itself on the lines of a more human-scale, community-based, local-resource-dependent societies…”

I don’t know if this forecast will come as predicted here, but it certainly could. And if it does, we need leaders who are prepared. In fact, even if this prediction doesn’t occur, such an increase of leadership on local levels could only help our society. Even if our major institutions remain big, even global, strong local leadership is vital to success—economically, politically and on a societal level.

A Breakdown of Local Leadership

In fact, it is the breakdown of exactly this kind of local leadership, I believe, which has caused such drastic growth of institutions that are too big and such widespread dependence on these institutions. Any organization that is too big to fail is, put simply, too big. Period. If it is too big to fail, its failure is a major threat—because all man-made institutions eventually fail. Most do so earlier rather than later.

The authors of Beyond Capitalism and Socialism get it right that the answer to our major current problems are rooted in our citizens and community, and that until we build strong local foundations across society we can only expect to witness further economic decay. They are also correct that neither capitalism nor socialism hold the answers, that a return to true free enterprise is essential, and that we must get started in this process rather than wait for some crisis to force such changes.

At times the authors get caught up in denominational debates from the Catholic perspective, but this tends to deepen the benefit of the book rather than detract. Readers do not have to buy into any religious themes to learn from the numerous commentaries on the potential of free enterprise society.

The book is invaluable reading for American, and all freedom-loving, citizens. As one of the authors wrote:

“Given a society, in which men, or the vast majority of men, owned property and were secure in their income, the myriad interactions of free men making empowered choices really would balance supply and demand. We would be astonished at the variety, the non-servility, and the creativity of our neighbors.”

I am convinced that this is both true and, especially in our modern world, profound. Still, I found the book lacking in one major detail. I prefer the term “free enterprise” to “Distributive,” first because I think it more accurately describes the philosophy for which it stands and second because I’m not convinced that free enterprise and distributism are precisely the same thing. They share many ideals, it is true, but there are differences.

For example, both free enterprise and distributism agree that:

- neither capitalism nor socialism is the ideal

- capitalism, in which those with wealth are treated differently by the law than those without wealth and the level of one’s wealth determines which laws pertain to each person, is flawed

- socialism, in which the government owns the major means of production and levels incomes and work assignments in an attempt to create long-term equity between all citizens and where one’s status is determined by one’s government position, is flawed

- the local society, economy and government is more important than the state- or national-level economy and government and should be treated as such

- families are the central institution of society, and they are more important than markets or governments; markets and governments exist to help families, not vice versa

- money is an important consideration in making choices for family, career, business and society, but it is less of a priority than relationships, spirituality and morality

- we have reached a point in the modern world where our societal dependence on big institutions—both government and corporate—is a serious weakness in our culture and causes much that is negative in our world

- a return to society that is more ideal, more locally-oriented, and citizens that are more independent and entrepreneurial is overdue. In such a society, most families would own their own businesses rather than remaining dependent on government or corporations for their jobs and livelihoods

Free Enterprise and Distributism

The big difference between free enterprise and distributive thought hinges on how we should move toward such a society. Dale Ahlquist, one of the authors in Beyond Capitalism and Socialism, suggested the following:

“The dilemma of Distributism is the dilemma of freedom itself. Distributism cannot be done to the people, but only by the people. It is not a system that can be imposed from above; it can only spring up from below….If it happens, it seems most likely that it would be ushered in by a popular revolution. In any case, it must be popular. It would at some point require those with massive and inordinate wealth to give it up.”

The desire for popular support is normal for all political groups, but the idea that Distributism “would at some point require those with massive and inordinate wealth to give it up” is alarming at best. Why would the wealthy have to “give it up?” Why is that necessary in free society? The word “required” is the problem. Fortunately, Ahlquist clarifies that this would be voluntary, so it isn’t Marxist, but it still makes me wonder, Why?

Nor is this the isolated view of just one author. Here is how another of the authors put it (and for this author voluntarism is replaced by government force):

“For instance, if I own one or several stores (say pizza restaurants) I would have a reasonable and normal rate of taxation, but as soon as I begin to assemble a chain of such businesses, then my rate of taxation would rise so sharply that no one of a normal disposition would seek to continue to own such a chain….A similar scheme of taxation would attack ‘multiple shops,’ that is, stores selling many lines of goods, such as a mega or ‘box’ stores, and stores with ‘large retail power.’”

Again, the obvious question is, why? The answer is that no big institutions can be allowed, that everything must by force remain small. This makes the same mistake as Marx, who taught that government would take from the rich and redistribute equally to all. The mistake was to think that those running the government wouldn’t keep a little (or a lot) extra for themselves and their families. In the Distributive ideal, where no institution can be allowed to be too big, the clear flaw is that any institution powerful enough to keep all the others small will have to be, well, big.

That means big government. The Distributists would presumably want the government to be local, but strong enough to keep all the other institutions small. The American founders already dealt with this and wrote about it extensively in the Federalist Papers. Madison, for example, said that nearly all of the colonies in the late 1780s suffered from local governments that were too dominant—they nearly all had corrupt and anti-freedom practices. This was one of the strongest arguments in support of the U.S. Constitution: a central entity would help reduce oppressive, intrusive and unfair governing fads which always arise in small (and therefore inbred) governments.

Clearly government has become much too big today, but a return to locales dominated by a few powerful families that ignore the needs of the rest of the people is not the answer—though it is precisely what would happen to most local governments if left to themselves. History is clear on this point.

We certainly need more local leadership, independence and a lot more entrepreneurialism and real ownership. We need good local government to make it work, and ideally a federation of local governments to maintain real freedom.

Is Taxation the Answer?

But back to the main point: Why would we want to use government taxation to keep any business from growing? If it offers a good product at a good price and people prefer its offering to those of other businesses, why should we drastically increase its taxes so that it remains small? Is smallness the central point? If so, this is the reason I prefer free enterprise. One more quote will suffice to further my point:

“Of course, a suitable period of time would be necessary to complete an orderly sell-off of property from excessively large owners to small owners before the new tax system came into full effect. Moreover, if this is instituted at a very reasonable pace, with tax rates on concentrations of property increasing gradually each year, this would give owners more time to prepare and help prevent a ‘firesale’ of their property. Similarly some form of guaranteed loans would have to exist to allow those without property or money to purchase the excess property that was being sold.”

My first thought when I read this was, “Who gets to determine what ‘excess’ means in such a society? Whoever it is, they’ll eventually keep more of the money and power than everyone else.” This one flaw in how the book describes Distributism is a serious problem. It proposes stopping one capitalist from getting too much wealth and power, but it doesn’t seem to realize that it also proposes taking the “excess” money from the capitalist and giving it to the socialist.

In contrast, free enterprise takes a different route. It establishes good laws that treat the rich, middle and poor the same. Period. That is freedom.

Is the U.S. a Free-Enterprise Economy?

Some people may believe that this is the system we live under in the United States today. Such an assumption is incorrect. The U.S. commercial code has numerous laws which are written specifically to treat people differently based on their wealth.

For example, it is illegal for those with less than a certain amount of wealth to be offered many of the best investment opportunities. Only those with a high net worth (the amount is set by law) are able to invest in such offerings. This naturally benefits the wealthy to the detriment of wage earners. This system is called capitalism, and it is a bad system—better than socialism or communism, to be sure, but not nearly as good as free enterprise.

In a free enterprise system, the law would allow all people to take part in any investments. The law would be the same for all. If this seems abstract, try starting a business in your local area. In fact, start two. Let the local zoning commissions, city council and other regulating agencies know that you are starting a business, that it will employ you and two employees, and then keep track of what fees you must pay and how many hoops you must jump through. Have your agent announce to the same agencies that a separate company, a big corporation, is bringing in a large enterprise that will employ 4,000 people—all of whom will pay taxes to the local area and bring growth and prestige.

Then simply sit back and watch how the two businesses are treated. In most places in the United States, one will face an amazing amount of red tape, meetings, filings and obstacles—the other will likely be courted and given waivers, benefits and publicity. Add up the cost to government of each, and two things will likely surprise you: 1) how much you will have to spend to set up a small business, and 2) how much the government will be willing to spend to court the large business.

This is the natural model in a capitalist system. Capital gets special benefits. Apparently, in contrast, in Distributist society the small business would pay little and the big business would have to pay a lot more. Under socialism, neither business would be established at all—at least not by you. A government official would do it all, or not do it.

In free enterprise, the costs and obstacles would be identical for the two businesses. In free enterprise, the operative words are “free” and “enterprise.”

Some Distributists seem to share the socialist misconception that unless government forces smallness, every business owner will push to become too big. Wendell Berry, a favorite writer of mine, often took the same tone. In reality, however, the evidence is clear that American business and ownership stayed mostly small—with most people owning family farms or small businesses—until the 1960s. It was government debt which wiped out the farming culture that dominated the South and Midwest, and the rise of big corporations over family-owned businesses came after the U.S. commercial code was changed by law to a capitalist rather than a free-enterprise model.

Give Freedom a Try

Instead of using government to force businesses to remain small, let’s consider giving freedom a try. It has worked for us in the past. If we altered the laws at all levels so that government entities treated all businesses and citizens the same, regardless of their level of capital in the bank, the natural result would be the spread of more small businesses. Freedom, not government control, is the answer.

With all that said, I’m convinced that at least some, maybe many or most, of Distributists in general and the contributing authors to Beyond Capitalism and Socialism specifically would agree with this point, that in fact their view of Distributism coincides with free enterprise. For example, Ahlquist’s chapter appears entirely supportive of free enterprise.

Still, I am concerned by this one thread of thought among some of the authors that seems to see government as the way to keep business from growing. Free enterprise gives no special benefits to big business like capitalism does, but it also does not force businesses to remain small. If this is the view of most Distributists, I agree with them. Even if we disagree on this point (and I’m not certain that we do), I find much to praise in this excellent book.

Quotable Quotes

Beyond this one concern, I can’t say enough positive about Beyond Capitalism and Socialism. It is greatly needed by our citizens today. Everyone should read it and ponder its application to our current world. Consider the following thoughts from this thought-provoking book:

“Home and family are the normal things. Trade and politics are necessary but minor things that have been emphasized out of all proportion.” –Dale Ahlquist

“What then is Distributism? It is that economic system or arrangement in which the ownership of productive private property, as much as possible, is widespread in a nation or society. In other words, in a Distributist society most…would own small farms or workshops…” –Thomas Storck

“As Political Economy is the child of Domestic Economy, all laws that weaken the home weaken the nation.” –Joseph McNabb

“The family, not the individual, is the unit of the nation.” –Joseph McNabb

“We don’t want to work hard. We don’t want to think hard. We want other people to do both our work and our thinking for us. We call in the specialists. And we call this state of utter dependency ‘freedom.’ We think we are free simply because we seem free to move about.” –Dale Ahlquist

“The conservatives and liberals have successfully reduced meaningful debate to name-calling. We use catchwords as a substitute for thinking. We know things only by their labels, and we have ‘not only no comprehension but no curiosity touching their substance or what they are made of.’” –Dale Ahlquist

“The real purpose of traveling is to return. The true destination of every journey is home.” –Dale Ahlquist

“[T]oday here in the United States of America, and in all industrialized countries…there is a class of men and women, perhaps the majority, that…is unfree….I mean, all those who subsist on a wage, the price paid for the commodity they have and who have no other means of maintenance for themselves and their families. I mean…all those who subsist on a wage that is paid to them by those who are, in actuality, their masters; a wage that may be withdrawn at any time and for any reason, leaving them on the dole, or to starve, if they can find no new job…These are not free men in any rational and exact sense of the word.” –Ralph Adams Cram

“Every man should have his own piece of property, a place to build his own home, to raise his family, to do all the important things from birth to death: eating, singing, celebrating, reading, writing, arguing, story-telling, laughing, crying, praying. The home is above all a sanctuary of creativity. Creativity is our most Godlike quality. We not only make things, we make things in our own image. The family is one of those things. But so is the picture on the wall and the rug on the floor. The home is the place of complete freedom, where we may have a picnic on the roof and even drink directly from the milk carton.” –Dale Ahlquist

“The word ‘property’ has to do with what is proper. It also has to do with what is proportional. Balance has to do with harmony. Harmony has to do with beauty….The word ‘economy’ and the word ‘economics’ are based on the Greek word for house, which is oikos. The word ‘economy’ as we know it, however, has drifted completely away from that meaning. Instead of house, it has come to mean everything outside of the house. The home is the place where the important things happen. The economy is the place where the most unimportant things happen.” –Dale Ahlquist

“Caveat lector! For there is little resemblance indeed of the real ownership of real property…to the ‘rent-from-the-bank’ home ‘ownership’ (sic) of most American families.” –John Sharpe

“Our separation of economy from the house is part of a long fragmentation process….Capitalism has separated men from the home. Socialism has separated education from the home….The news and entertainment industry has separated originality and creativity from the home, rendering us into passive and malleable customers rather than active citizens.” –Dale Ahlquist

“In the age of specialization we tend to grasp only small and narrow ideas. We don’t even want to discuss a true Theory of Everything, unless it is invented by a specialist and addresses only that specialist’s ‘everything.’” –Dale Ahlquist

“In material things there can be no individual security without individual property. The independent farmer is secure. He cannot be sacked. He cannot be evicted. He cannot be bullied by landlord or employer. What he produces is his own: the means of production are his own. Similarly the independent craftsman is secure, and the independent shopkeeper.

No agreements, no laws, no mechanism of commerce, trade, or State, can give the security which ownership affords. A nation of peasants and craftsmen whose wealth is in their tools and ski and materials can laugh at employers, money merchants, and politicians. It is a nation free and fearless. The wage-earner, however sound and skilful his work, is at the mercy of the usurers who own that by which he lives.

Moreover, by his very subjection he is shut out from that training and experience which alone can fit him to be a responsible citizen. His servile condition calls for little discretion, caution, judgment, or knowledge of mankind. The so-called ‘failure of democracy’ is but the recognition of the fact that a nation of employees cannot govern itself.” –John Sharpe

Whether you agree or disagree with the details, this book is a treasure of great ideas to consider, discuss, ponder and think about. We need this book today, and we need a society that has read it and deeply contemplated its numerous profound concepts.

Whether or not the ideas in Beyond Capitalism and Socialism become necessary to all of us through some major crisis ahead, a national consideration of these topics is long overdue. We do need to move beyond capitalism and socialism. We need a rebirth of free enterprise, for our nation, economy, freedom, prosperity and above all, for our families and communities.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Book Reviews &Economics &Entrepreneurship &Featured &Government &Liberty &Mini-Factories &Producers &Prosperity &Tribes

A Big Problem

June 17th, 2011 // 11:11 am @ Oliver DeMille

Be Afraid

We have a problem. We have a big problem. Or, as the old quip put it, “Be afraid. Be very afraid.”

As an optimist, I am usually skeptical of anything that sounds overly negative. However, I recently read a list of statistics in the Harper’s Index that I think is cause for serious concern.

Two items on the list have received a lot of press:

- Standard and Poor’s “revised its U.S. debt outlook to ‘negative’” on April 18, 2011.

- It has never before ranked the U.S. anything but ‘stable.’”

This should give us all pause. But this is a fixable situation, one which can be solved by a return to American entrepreneurialism, initiative and ingenuity.

The increase of unemployment once again in May 2011 can likewise be effectively overcome by government policy changes that incentivize private investment and spending. Many corporations are sitting on significant surpluses right now, but they are loathe to spend them without a real change in the way the U.S. government spends money and treats business.

In short, our current economic problems can be dealt with by the principles of freedom and free enterprise—if only Washington would give freedom a try. Note that neither Republican nor Democratic presidents have taken this approach for over two decades.

American vs. Chinese Views on the Free Market

But these aren’t the statistics that should worry us most. The figures which really concern me have gotten little media attention:

- Percentage of Americans in 2009 who believed the free market ‘is the best system on which to base the future of the world’: 74

- Percentage of Americans who believe so today: 59

- Percentage of Chinese who do: 67

If this trend continues, we’ll face drastically worsening major problems.

Unease about the growth of China’s power has been increasing in the U.S. for some time, but the concern has mostly centered on America’s economic decline versus the growth of China as a major totalitarian world power.

Add to this the knowledge that over two-thirds of Chinese believe free enterprise is the key to the future—at the same time that American belief in free enterprise is waning—and our sense of what the 21st Century will bring takes on a new direction.

In the United States, youth are widely taught that the key to life and career success is getting a good job, while in China an emphasis for the “best and brightest” in the rising generation is to engage meaningful entrepreneurship.

If this continues, the status and roles of these two nations will literally switch in the decades ahead: China as superpower, the U.S. as a second-rate nation with a stagnant and struggling economy. Many experts point out that China has a long way to go to “catch up” with the U.S. in military strength, but how long will this take if the U.S. economy continues to decline while China’s booms?

I have two main thoughts on this: First, good for the Chinese people! If they can consistently nudge their society and government in the direction of increased freedom, they will join or possibly even become the world’s most important leaders. The truth is that freedom works—in China as much as everywhere else. Second, and most importantly, America needs to give freedom a chance.

A majority of Americans believe in free enterprise, but many in Washington seem convinced that the government can do things better than the American people. The future of our freedom and prosperity depends on a flourishing environment of freedom.

Government can do us all a great service by altering its current policies and removing the numerous obstacles to free enterprise. This one significant shift is vital. The fact that many of our national leaders seem committed to avoiding such changes is a big problem. The longer this lasts, the bigger the problem becomes.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Culture &Current Events &Economics &Entrepreneurship &Foreign Affairs &Government &Producers &Prosperity

A Case for Innovation

May 3rd, 2011 // 2:21 pm @ Oliver DeMille

A Review of The Comeback: How Innovation Will Restore the American Dream by Gary Shapiro

There are two great modern visions of how to help our economy grow and flourish. One holds that the government is the center of economic prosperity, the other believes in innovation. The first attempts to tax and spend, the second believes in the power of free enterprise.

The Republican Party sometimes tries to present itself as the promoter of the second view, and at times the Democratic Party attempts to make this same argument a criticism of Republican policies, but in actual policy both major political parties tend to legislate for the first view. In contrast, Gary Shapiro’s important book The Comeback outlines what Washington needs to do truly bring the economy back. This includes:

- Stop penalizing investments in start-ups.

- Direct any public funding of start-ups by private investors, not by government bureaucrats.

- Let any company fail, according to the rule of the free market.

- Make economics, business and entrepreneurialism studies part of the public school curriculum.

- Ensure that business tax rates are transparent and predictable.

- Change tax laws to favor investment over debt.

- Reform immigration to encourage entrepreneurial risk-taking.

- Pass more free-trade agreements.

- Reform education by allowing teachers to teach.

- Measure all government spending by how well it is working.

- Measure all government spending by how it meets serious national needs.

- Link the compensation of our federal legislators to our annual national deficit.

Shapiro includes a number of other specific proposals for an American comeback. Not every reader will agree with every policy proposal. I found myself disagreeing with a number of points. For example, Shapiro’s argument that, “You can’t legislate progress” is clearly too narrow—just consider the legislative successes against racist and religiously-bigoted behavior.

On the whole, however, Shapiro’s voice is an important contribution to the ongoing debate. More citizens and government officials need to read and internalize his book. Shapiro shows a mature appreciation for the important role of the government in the economy, and simultaneously notes that without real economic freedom no significant American comeback is likely.

He ultimately pins the future of America on innovation, not on either major political party or on any government policy. The government can do much to encourage a flourishing economy, but the innovators will primarily determine our economic future. Shapiro writes:

“Innovation is America. It is our special sauce, our destiny, and our best and only hope for escaping the economic malaise…. Our best hope is for government to foster innovation by creating a fertile ground for innovation to flourish.

“Innovation is the natural by-product of the free market….

“Our nation is looking into the abyss. With a blinding focus on the present, our government is neglecting a future that demands thoughtful action. The only valid government action is that which invests in our children. This requires hard choices. We cannot leave the rising generation with a mountain of bad debt. This will require suffering in the present….

“America is in crisis. What is required is a commitment to innovation and growth. We can and must succeed. With popular and political resolve, we can reverse America’s decline…. America must become the world’s innovative engine once again; we cannot fail. Only then can I return to China and tell that Communist Chinese official that America is back.”

Shapiro’s voice is important, and the voice of innovation is vital to America’s future. Unless we find ways to reinvigorate our national penchant for innovation, the future of our economy and nation is bleak. More of us need to join Shapiro in discussing ways to refocus our nation on innovation. Government certainly has a positive role to play in successful society, and only by encouraging widespread innovation can we hope to see sustained growth and an economy that is the envy of the world. Two centuries of American leadership have proven that freedom works. It’s time to remember and more vigorously apply freedom in our modern economy.

**********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Blog &Book Reviews &Economics &Producers &Prosperity

A Tale of Two Economies

April 11th, 2011 // 5:56 am @ Oliver DeMille

The United States currently houses two economies, and they are drastically different. The regular people have to deal with the following realities:

- Energy costs are still going up, and may skyrocket in the wake of nuclear problems and the impact of the Arab uprisings on oil prices.

- The price of crude oil is up 25% since the beginning of 2011, and it is still rising.

- Food costs are rising accordingly.

- Unemployment remains high and may increase again.

- The real estate bubble is not yet over, and many experts are concerned about another major dip.

- Many state governments are facing massive shortfalls and/or bankruptcy.

In contrast, millionaires increased their wealth approximately 16% during the Great Recession, and big business has likewise upped its wealth. Ken Kurson wrote in the April 2011 issue of Esquire:

“American corporations are sitting on an unholy pile of cash. About $2 trillion. It’s an all-time record, and as a percentage of total assets, it’s the highest in more than 50 years.”

These two economies do share one thing, however: a widespread fear of the future. Kurson continued:

“I would argue that this wad of dough actually greatly exceeds even the pile-up of the late 1950s, because of the reason it exists. Past cash hoardings were strategic in nature. They funded the expansion of product lines, plant building, technological innovation, and hiring that we witnessed in the mid-’60s, for example, after President Kennedy dramatically lowered the personal income tax. This time is different. The current stockpile isn’t strategic; it’s fearful. Companies are afraid to expand because of uncertainty about costs, and a lack of lending partners.”

Kurson suggests that this choice by the corporations is probably unwise—the government may use it as an excuse to find ways to take this money and spend it. More likely, corporations will invest it abroad.

Dante Chinni and James Gimpel point out that disparity between those with increasing wealth and the rest applies to both individuals and whole communities. In the April 2011 issue of The Atlantic these authors outline the twelve types of communities in the U.S.: Monied Suburbs, Minority Urban Centers, Campus Communities, Industrial Metropolises, Immigrant Communities, Service Worker Tourist Hubs and Midsize Cities, Emptying Nest Communities, Evangelical Epicenters, Mormon Outposts, Military Bastions, Tractor Country, and Boomtowns.

Of these, only four have annual median family incomes over $50,000 a year: Monied Burbs, Campus Communities, Boomtowns and Industrial Metropolises. Interestingly, these four and Military Bastions are the only communities where median family income is higher in 2010 than it was in 1980. As most people in the middle class have seen their standard of living stagnate since 1970 and significantly decrease since 2008, the top 7% of earners have greatly increased their wealth during the major global economic downturn.

Despite all the evidence, there are still those who consider many current government proposals “socialist.” This is at best a myth. At worst, it is a threat to our freedoms because if the regular people misunderstand the problem they are sure to fall short when they try to apply solutions. Yes, one symptom of socialism is massive government spending and taxation of the middle class to pay for state programs. But socialism is, as I have mentioned a number of times, a transfer of money from the middle and upper classes to the lower class. And we have not seen this in recent American administrations—Bush, Clinton, Bush or Obama.

What we have seen, in policy after policy, is a transfer of wealth from the middle classes to the upper class. Bailout money came from the middle class and was largely deposited in upper-class and big corporate bank accounts.

Unfortunately, we are living in a strange era of Orwellian doublethink. Liberals inaccurately call this great transfer of money from the middle to the upper class “conservative” while conservatives incorrectly label it “socialism.”

Let’s cut through the name calling and just call it what it is: Using government power to transfer money and wealth from the middle classes to the upper class is aristocracy, pure and simple. Aristocratic conservatives and aristocratic liberals have greatly benefitted from this trend, and they keep the rest of the nation from doing anything about it by arguing among themselves. Conservative and liberal aristocrats point fingers at each other, accuse and call names, and tell us to send more money to one side or the other.

The rest of the people, the non-elites, foot the bill because they get caught up in the arguments promoted by the two kinds of aristocrats. We are witnessing—and this is not an overstatement—a fundamental shift from our roots as a limited federal democratic republic to an aristocracy where the Commercial Aristocrats battle the Governmental Aristocrats for ascendency and the rest of the people see their freedoms and prosperity dwindle with each passing decade. Aristocrats make up one economy (one that is flourishing at record levels in both wealth and power), while the rest of the people make up the other economy (one that is deeply struggling).

Let’s call a spade a spade. We are moving toward aristocracy, and it is time to stop following or supporting aristocrats—regardless of which party they promote. We need America’s “second” economy, the regular people, to start increasing their leadership.

***********************************

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

Oliver DeMille is a co-founder of the Center for Social Leadership, and a co-creator of Thomas Jefferson Education.

He is the co-author of the New York Times, Wall Street Journal and USA Today bestseller LeaderShift, and author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, and The Coming Aristocracy: Education & the Future of Freedom.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Aristocracy &Blog &Culture &Economics &Prosperity