Three Trends vs. Freedom by Oliver DeMille

July 2nd, 2014 // 12:57 am @ Oliver DeMille

Rewriting the Future

There are at least three great political-economic changes that have occurred in the United States in the last twenty years. Each is rewriting what our world and future looks like, and each is causing a decline of freedom. But none of them are inevitable.

There are at least three great political-economic changes that have occurred in the United States in the last twenty years. Each is rewriting what our world and future looks like, and each is causing a decline of freedom. But none of them are inevitable.

The first trend is the huge growth of government, including government size, spending, and regulation in so many parts of our lives. The second is the major decline of success and opportunity for the middle class. The third is the increasingly important rise of China.

Put these three together, and the future seems bleak to many Americans—even if they aren’t sure why.

The irony is that the first two trends are, in fact, related. Despite what many in Washington say, the massive growth of government is at least contributing to—and may be the main cause of—the growing middle class squeeze.

Breaking the American Dream

Sadly, too many in government don’t see it that way. For some reason, a lot of people witness the deepening plight of the middle class and, inconceivably, think that the only solution is bigger and bigger government. More programs, more spending, more intervention, more regulation.

Yet the historical record is clear. Every major growth of the U.S. government has been followed by a decrease in the middle-class standard of living. Today, after over sixty years of unprecedented expansion of government, the average adult American worker can no longer provide a quality standard of living for a family. In fact, two working adults in a family seldom make ends meet.

Families are smaller, the American Dream of home ownership is switching to a European model of rentals, and more people are joining the lower classes—where family debt or government money, or both, are necessary to get by.

In fact, home ownership, once a staple of middle class lifestyle, is increasingly a financial burden on many people (see “Americans think owning a home is better for them than it is,” The Washington Post, April 21, 2014). In an article entitled “The American Middle Class Is No Longer the World’s Richest” (April 22, 2014), The New York Times reported that the U.S. middle class is getting poorer and as a result “most American families are paying a steep price for high and rising income inequality.”

Middle Going Down

The middle class young are being hit especially hard. Over 40% of today’s Millennial Generation young people move back home after leaving for college or work. As a group, they are the first generation since World War II to be significantly worse off financially than their parents. They aren’t buying cars, they aren’t buying houses, and they aren’t getting married; they’re living at home, hoping something will change in the economy to bring more opportunity (see Paul Taylor, CBS This Morning, April 26, 2014).

The middle class young are being hit especially hard. Over 40% of today’s Millennial Generation young people move back home after leaving for college or work. As a group, they are the first generation since World War II to be significantly worse off financially than their parents. They aren’t buying cars, they aren’t buying houses, and they aren’t getting married; they’re living at home, hoping something will change in the economy to bring more opportunity (see Paul Taylor, CBS This Morning, April 26, 2014).

Speaking of the American middle class, Harvard’s Lawrence Katz wrote: “In 1960, we were massively richer than anyone else. In 1980, we were richer. In the 1990s, we were still richer.” Today we aren’t (op cit. “The American Middle Class…”).

A simple comparison of low regulation in 1960 to increased but still (by today’s standards) low regulation in 1980, then increasing regulation in the 1990s and massive regulatory increases between 2000 and today show a clear pattern: when we raise regulation and grow government, we hurt the middle class and grow the lower class.

Yet many experts suggest that the solution is more, not less, government intervention, programs, spending, and regulation (see ibid). This mirrors the old quip that “the beatings will continue until the morale improves,” except in this case “economy- and innovation-killing regulation will increase until the economy improves.” In reality, the opposite is occurring—bigger government is hurting the middle class and increasing income inequality.

The Choice

Whatever the experts think, the American people have a deep sense that something is wrong. Approximately 70 percent don’t believe America is on the right track (ibid).

This doesn’t translate directly to elections, however. A lot of people think that government is the solution to our economic problems, not the cause of some of our deepest challenges.

If current trends continue, China’s increasingly competitive economy will make a reality of what many in the American middle class now believe: that our children and grandchildren will face a declining standard of living while the same generations in China will see major economic increases.

Like a George Orwell satire, we continue to do exactly what causes more problems. Yet perhaps the greatest American contribution to history—a deep belief in and commitment to moral freedom and free enterprise—goes mostly unheeded. America needs to give its own greatest export (freedom) a try.

Freedom works, as we have shown for over two centuries. Whether America declines or flourishes in the 21st Century will be directly attached to whether we choose bigger government or increased freedom. And it’s up to the middle class to make this decision and make it stick.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah

Category : Aristocracy &Blog &Citizenship &Community &Current Events &Generations &Government &History &Leadership &Liberty &Mission &Politics &Statesmanship

Symbolic Language

April 22nd, 2014 // 3:32 pm @ Oliver DeMille

Two Different Americas

There are two classes in modern America, the literal class and the metaphorical class. In the increasing divide between the “haves” and the “have nots,” this language difference is central.

In the increasing divide between the “haves” and the “have nots,” this language difference is central.

Those who don’t understand the language of metaphor are falling behind in the widening gap that is the global economy. They are watching their family’s standard of living decrease over the decades.

This trend will only increase in the years ahead.

Those with a quality education learn to think, to readily see symbolism wherever it is found. But most Americans and Westerners are part of the literal class—symbolism is often lost on them.

They tend to see things without the metaphor.

Parental Guidance

For example, last year a long debate raged on social media about whether or not The Hunger Games trilogy was good or bad reading for youth. The most interesting thing about this debate wasn’t the arguments made by either side, but the fact that symbolism was hardly ever part of the debate.

But the symbolism is glaring: A nation sacrifices its helpless children for the convenience, entertainment, and libertine moral values of the urban upper class, while government, media, and big wealth combine to keep their control over the outlying, rural people dedicated to “archaic” family values.

What could be a closer parallel to our modern society? And what metaphor could ever more clearly point out the hypocrisy of the American cosmopolitan class and its views on abortion?

What Was Missed

To anyone trained in symbolism, the metaphor is obvious. We watch children killed for the convenience and political values of the elite class. And note that in The Hunger Games the urban classes have collectivist economic views combined with libertine moral values—the same as those in the real world who support Roe v. Wade and easy abortion laws in modern America.

This is blatant symbolism, but only the upper classes really understood this.

In fact, some of the most vocal voices declaring that The Hunger Games books and movies are inappropriate for youth came from people who are strongly against abortion.

They just didn’t understand that The Hunger Games was probably the biggest, best, and most popular anti-abortion movie ever. This was entirely lost on the literal classes.

When the ruling classes understand literal and symbolic language, while the masses only understand the literal, freedom is in decline and the power of the ruling classes will only increase.

This was true in Shakespeare’s day, in the time of Virgil, and when the Psalms and Proverbs were written.

The elite classes, steeped in the classics and great books that teach readers how to think (especially symbolically), are always going to rule over the literal classes whose education is limited to getting the “right” answers, preparing for jobs and careers, and not really thinking about things symbolically.

Allan Bloom warned that modern America has this problem at the level of Hitler’s Germany.

The Real Fascination

Another example: People in the literal classes can’t quite understand why today’s youth are so intrigued by vampire books, movies, and television programs. “What is this fascination with vampires?” the literal classes ask.

The elite classes, well-versed in metaphor and symbolism, know better. They understand that vampires are symbols of something—something many young people struggle with.

Imagine a society made up of two major groups. First are the hard-working, regular people who live in middle-class neighborhoods, go to work every day, raise families, sleep during the night (because they have to go to their job tomorrow), send their kids to school in order to get a good career in their adult lives, etc.

The second group in society is made up of a few people who have trust funds, inherited wealth, can get in trouble with the law but get out of it relatively easily, stay up through the night at fancy balls and dinners, then go home in the early morning and sleep late into the day, and have more power, wealth, fun and entertaining lives, and sophisticated connections with other aristocrats far beyond the local community—and even around the world.

The first group envies the second, while the aristocratic second group hardly gives a thought to their “inferiors.” Parents of both groups warn their children not to mix with the other group—because it inevitably causes many problems.

This clearly defines two things: 1) an aristocratic society, like all elite societies that have existed in human history, and 2) every group of vampires portrayed in literature, juvenile fiction, and in movies and TV programs.

But the literal classes mostly miss this symbolism. “Why do the kids like vampires?” the literal classes ask.

Some literal writers even try to explain how youth like to be scared, so they love the idea of biting strangers dressed in black. So literal. So shallow.

Answer: The kids don’t love actual vampires, they love the idea of rising into a higher class. In high school, this is a driving passion for many teenagers. If movies are to be believed, it’s the driving theme for most students in most high schools.

In such an environment, vampires are the shortcut to social success. If one bites you (dates you, likes you, includes you in his group, etc.) you immediately climb to a higher social class. The highest social class, in fact.

The one that has the money, the power, the mystery, and the worldwide connections (rather than the homegrown limits of the coal mines, a job at Blue Bell’s Rammer Jammer, or a lifetime of alumni fundraising for the Friday Night Lights).

The fact that many parents tell you to ignore the vampires (“Don’t worry about high school cliques, or being popular. It won’t even matter after you graduate.”) just adds to the intrigue.

Vampires are aristocrats. Elites. People with enough money, power and connections to ignore the limits most people and families struggle with—as youth, and also as adults.

The kids instinctively understand this, though their literal parents may not.

The Old Tool

This language barrier isn’t new.

In aristocratic Britain, the upper classes pronounced words differently than the lower and working classes—so elites would always know who they were dealing with. In fact, the pronunciations were literal (pronounce every syllable) versus symbolic (skip syllables, if you’ve been trained by other aristos and know what to look for).

For example, the word Worchester was pronounced “wor-ches-ter” by the lower classes, but simply “wis-ter” by the nobles. Or the name St. John was pronounced “Saint John” by working classes but “Sinjin” by nobility (see Jane Eyre). There are thousands of similar words.

This boils down to two classes, the Literal versus Symbolic. Checkers versus Chess. “Tell me the right answer, so you can pass the test and someday get a good job,” versus “Tell me your opinion, because there are many possible correct answers, and our purpose is to help you learn how to think—so you can become a leader.”

These are how public schools versus elite prep schools, respectively, generally teach.

The Price of the Literal

Facts versus Metaphor. Precision versus Imagery. One Meaning versus Poetic Allegory.

Again, the elite classes are well educated in both of these dialects. The problem is that the middle and lower classes are not. They only know the literal meanings of words.

This is a growing concern, because it causes increased divisions between the elites and the regular people. The masses don’t understand what is happening to their society, because they don’t speak the language of metaphor. When President Obama promised, “If you want to keep your doctor [under Obamacare], you can keep your doctor,” the two classes heard very different things.

The literal classes heard: “If you want to keep your doctor, you can keep your doctor.” Hearing this, they planned their family and business finances and voted accordingly.

The symbolic classes, trained in metaphor, heard the following: “If you want to keep your doctor, you can keep your doctor, or at least one that is just as good; or, even if you can’t keep your doctor under the new plan, the nation will be better off, so it’s worth the change anyway.”

The symbolic class knows that political promises are rhetoric, meant to win elections—not meant to actually, literally be fulfilled. The literal class is slowly realizing that this is the case, but they still feel lied to by each new candidate. In reality, they just don’t understand metaphorical language.

A teacher I know once shared the following quote by Groucho Marx with her class: “Outside of a dog, a book is a man’s best friend; inside of a dog it’s too dark to read.” One student was very frustrated with this little proverb. When questioned, the student said emotionally, “This is so cruel to dogs. Why would anyone want to read inside of a dog?”

When the literal class doesn’t easily and immediately understand symbolism, it will lose its freedoms to the elite ruling class that does.

The Missed Symbols

I wonder what people will say about the book and movie popularity of Divergent. It is a great symbolic attack on the modern public school system and the way we choose careers and jobs in the U.S., Canada, and Europe—but I bet there will be a number of homeschoolers, charter school and non-traditional educators and parents who miss some key points.

First: this is not a book for youth; the intermittent suggested sensuality that is predictable and “natural” for youth in crisis who depend upon each other without family support is not suitable for most youth.

Second: this book is for adults, and it may be the best promotion for homeschooling and other cutting-edge, new educational choices since…well, ever.

If non-traditional education seizes this opportunity, there will be a lot of support for Divergent, because people will understand its symbolism: Each person is different, and each person has unique genius inside.

The purpose of education is to help each student discover and develop his or her inner genius and passion, and use it to improve and serve the world. When the focus is on making every child fit in, it’s not education at all. At best it’s training, at worst brainwashing.

This is the overarching message of Divergent—but will it be lost on the literal class? I hope not.

We all can benefit from including more symbolic thinking in our reading. It’s like a new mantra for 21st Century leadership: Read more, think more, serve more. And look for symbols and metaphor in everything you read.

Join Oliver for Mentoring in the Classics >>

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Aristocracy &Arts &Blog &Book Reviews &Citizenship &Community &Culture &Education &Family &Leadership &Liberty &Mission

Why Do We Keep Losing the Freedom Battle?

March 20th, 2014 // 3:00 pm @ Oliver DeMille

Two Avenues of Destruction

Why does government keep growing, no matter who we elect, no matter which party is in charge?  Why do freedom lovers, those who truly want limited, Constitutional government, continue to lose the battle?

Why do freedom lovers, those who truly want limited, Constitutional government, continue to lose the battle?

There are two answers. First, the freedom battle loses—year after year, election after election, decade after decade—because it is poorly funded. The political parties are well funded, mind you, but neither party truly stands for freedom. Freedom lovers lose because they are underfunded, pure and simple. More on this below.

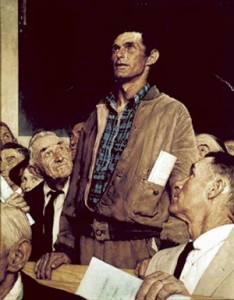

Second, those who stand for freedom lose the battle to bigger government because the regular people can’t see what is happening. We don’t see armed troops in jackboots marching daily through our streets, entering our homes, and stealing our property and lives.

When the people can’t see this happening, it’s hard for them to get too excited about it. They don’t know what to fight against. They don’t know who the enemy is. They aren’t sure who to fight, or how to fight them.

The Paper Sword

We don’t realize that Soft Power attacks (certain licensing requirements, regulations, agency policies, commercial codes, revenue bills, statutory changes, executive orders, secret agency procedures, exemptions, ex post facto decisions, and court cases) are as dangerous to freedom as Hard Power attacks (invading armies, armed rebellions, political officials with their own armies, or government use of force against its own people).

In history, the regular people often respond to Hard Power attacks on freedom, but they seldom even notice Soft Power attacks until their freedoms are too far gone to recover.

Citizens of nations almost never realize it when Soft Power is attacking them. The biggest irony of this is that throughout human history Soft Power has taken away more freedom than Hard Power. In fact, Hard Power is seldom used until Soft Power has weakened a nation.

Today, we are witnessing a wholesale reduction of our freedoms—nearly all through Soft Power attacks that few people notice.

To See and Understand

As one insightful friend wrote to me in an email: “We don’t know who or what to fight against. I still believe the majority of Americans value freedom… We, as a culture, do not know how to defend freedom in this new age of information, nor do we know who or what to defend it from. All the average citizen sees—or is supposed to see—is things going a little darker, a little dirtier, a little more crowded, each day. There is, for most Westerners in any case, no force-of-state brutes-in-boots and uniforms…. We see only the results of class stratification and economic divergence…. The most dangerous enemy is the one you can’t see.”

Americans would stand up and vote to get their freedoms back, if only they understand how much they are under attack.

If they could see their freedoms being stolen by Hard Power attacks at the level that they are truly under siege from Soft Power, they’d change things—and fast.

But the regular people don’t see, because Soft Power is used behind-the-scenes, on paper.

How to Win It

This is why only a nation of voracious readers can maintain its freedoms. This brings us back to the first reason freedom is losing: underfunding.

Not only do we need a nation of voracious readers, we need a lot of successful businessmen, professionals, entrepreneurs, and others of means to fund freedom—to fund those things that help the regular people see and understand the impact of Soft Power.

This is the current battle for the future of freedom.

1. Will people of means fund effective responses to Soft Power attacks on our freedom?

2. Enough to win the battle?

3. ill enough regular people take entrepreneurial action and become people of means?

On these three questions turn our future.

Which of these three battles are you helping fight?

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Aristocracy &Business &Citizenship &Community &Constitution &Current Events &Economics &Entrepreneurship &Government &Leadership &Liberty &Mini-Factories &Mission &Politics &Statesmanship

Why Freedom is Losing: The Battle for Our Future

February 18th, 2014 // 5:24 pm @ Oliver DeMille

De Jouvenel said it all in one profound paragraph:

“From the twelfth to the eighteenth century governmental authority grew continuously. The process was understood by all who saw it happening; it stirred them to incessant protest and…reaction. In later times its growth has continued at an accelerated pace…And now we no longer understand the process, we no longer protest, we no longer react. This quiescence of ours is a new thing, for which Power has to thank the smoke-screen in which it has wrapped itself…Masked in anonymity, it claims to have no existence of its own, and to be but the impersonal and passionless instrument of the general will.”

Let’s break this down, point by point, to understand it better:

- “From the twelfth to the eighteenth century governmental authority grew continuously. The process was understood by all who saw it happening; it stirred them to incessant protest and…reaction.”

As kings, rulers, and aristocratic upper classes took more and more power to themselves, and increasingly more over the regular people, the regular people saw what was happening and tried to stop it.

This culminated in the American Revolution and French Revolution, which happened within a few years of each other.

The American Revolution focused on replacing the old monarchial-aristocracy with a new, constitutionally established government of freedom for all classes. In contrast, the French Revolution emphasized killing off the old — literally executing royals and aristocrats in the hope that with their demise the regular people would gain liberty.

The American method quickly proved more effective in promoting freedom.

- “In later times its growth has continued at an accelerated pace.”

Today’s regular citizen has less power than people did even a few generations ago, and our grandchildren will have even less — unless something changes very soon.

- “And now we no longer understand the process, we no longer protest, we no longer react. This quiescence of ours is a new thing, for which Power has to thank the smoke-screen in which it has wrapped itself…Masked in anonymity, it claims to have no existence of its own, and to be but the impersonal and passionless instrument of the general will.”

When those increasing their power were kings and aristocracies, the regular people knew what was happening.

Today, when the new ruling class is a nameless, faceless, unknown elite, the regular people do nothing. They don’t know who is taking away their freedoms, or what to do about it.

Yet power is being lost by the regular people — and gained by the ruling elite — at higher rates than ever before. The gap between the 90 percent and the 10 percent is drastically increasing, but not nearly as much as the gap between the 10 percent and the 1 percent. In fact, the power and wealth gap between the 1 percent and the .1 percent is widening even more rapidly than the others.

If current trends continue, a tiny, ultra-powerful elite will rule our formerly free nations in a way never known before in history — and hardly anyone knows who the new rulers are. They rule by policy, influence, spin, currency transfers, behind the scenes. But their power is still growing.

De Jouvenel wrote of this in 1945, and today the power of this ruling elite only increases. In the conclusion to his great book, On Power, he warned:

“We are the witnesses of a fundamental transformation of society, of a crowning expansion of power…A beneficent authority will watch over every man from the cradle to the grave…controlling his personal development and orienting him towards the most appropriate use of his faculties.

“By a necessary corollary, this authority will be the disposer of society’s entire resources, with a view to getting from them the highest possible return…Power takes over…the whole business of public and private happiness and…all possessions, all productive energies, and all liberties should be handed over to it…The business is one of setting up an immense patriarchy, or…a matriarchy, since we are now told that collective authority should be animated by maternal instincts.”

Today’s Americans are the recipients of this prophecy come true. Today’s newspaper of record, The New York Times, announces that the new “Health Care Law May Result in 2 Million Fewer Full-Time Workers.”

Because Obamacare requires much higher costs for employers to maintain full-time employees, there is a nationwide trend to downsizing employee workweeks. People are supposed to tighten their belts, make do on less income, and pay higher taxes. This is a massive shifting point for the economy.

Many corporations are avoiding the increased taxes and health care costs by moving their operations offshore, to other nations, citing less regulation and more business-friendly tax codes. It’s hard to blame them for seeking greener pastures and shores with more freedom.

Families that were once supported by one wage earner now can’t make ends meet with the incomes of both parents — so they go deeper into debt.

The American Dream is dying.

A new ruling class is rising behind the scenes.

A different future — a lowering standard of living — awaits our children and grandchildren.

Unless something changes.

Regular Americans walk past dusty books on shelves (full of real solutions for our current national problems), click on the television, and settle in for an evening of entertainment…

Somewhere there is a fading memory…of fiddling while Rome burns.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Aristocracy &Blog &Education &Government &History &Liberty &Politics &Statesmanship

The Legacy of 2013?

January 8th, 2014 // 1:31 pm @ Oliver DeMille

The year 2013 is over, and it may go down in history as another drastically negative year like 1913. The hundred year itch? Maybe.

The year 2013 is over, and it may go down in history as another drastically negative year like 1913. The hundred year itch? Maybe.

The year started out with high political drama as Republicans and Democrats argued late into the nights on January 1 and 2 in search of a fiscal cliff agreement.

In May and June we watched a domino series of major scandals, including the IRS targeting of conservative groups and the revelation that the NSA is consistently spying on all American citizens.

The drama didn’t let up over the summer, culminating in the widely watched government shutdown in October.

Then came the rollout of Obamacare, and the fact that no, you can’t “keep your doctor, or your insurance company,” no matter what the President promised.

Many Americans lost all faith in politicians — all of them.

But the worst news came in December, with the little-publicized announcement of the two major things that will most likely stand out about 2013:

- First, China landed a probe on the moon, symbolizing a new level of Chinese expansion into world leadership.

- Second, the news came out that during 2013 state governments in the United States passed over 40,000 new laws.

That’s not a typo. It’s 40,000 new laws — which means five times that many regulations when all the agencies of government write these laws into agency policies. It’s even more if you add the new federal laws.

Taken together, these signal a serious period of decline for America. We are a nation being overtaken by our biggest competitor (some would say future enemy) China, and simultaneously mired in skyrocketing levels of regulation.

Governments, federal and state, now seem determined to regulate and overregulate every facet of our lives — private and business. Many entrepreneurs, who were already reeling from reams of Obamacare regulations, are now facing more government red tape from every flank.

The free enterprise economy is literally under siege. Those who think this is exaggerated should try to open a significant new business in the United States. Most of the biggest entrepreneurs and corporations who have attempted this recently have decided to build in China or some other economy instead. The U.S. government has become generally hostile to business.

This is a strange reality for the land of the free and the home of the brave. Long considered the bastion of world freedom and economic opportunity, America is consistently less appealing to many businesses and investors.

The December 31, 2013 issue of USA Today summarized this overarching trend by saying that “aristocracy” is now “in” in America.

Aristocracy, really? That’s a bold statement. Yet it is increasingly true. The lower classes are more dependent on government, and the middle classes only survive by using debt. Only the upper class, the elites, are financially flourishing — and many of them rely on international investment that is growing in foreign economies.

Anyone relying on the U.S. economy right now is concerned. What will the escalating rollout of Obamacare bring? How many more government regulations will come in 2014, and how will this further weaken the economy?

The experts are finally taking notice of sharply rising levels of regulation, even if Washington isn’t.

For example, Francis Fukuyama called our time “The Great Unravelling” (The American Interest, Jan/Feb 2014) and Steven M. Teles called it “Kludgeocracy in America” (National Affairs, Fall 2013). We have become a Kludgeocracy indeed, with more business-killing regulation every week.

In The Discovery of Freedom, Rose Wilder Lane said that,

“Men in Government who imagine that they are controlling a planned economy must prevent economic progress—as, in the past, they have always done.”

What is her definition of a planned economy? Answer: modern France, Britain, and the United States. She quoted Henry Thomas Buckle, who wrote:

“In every quarter, and at every moment, the hand of government was felt. Duties on importation, and on exportation; bounties to raise up a losing trade, and taxes to pull down a remunerative one; this branch of industry forbidden, and that branch of industry encouraged; one article of commerce must not be grown because it was grown in the colonies, another article might be grown and bought, but not sold again, while a third article might be bought and sold, but not leave the country.

“Then, too, we find laws to regulate wages; laws to regulate prices; laws to regulate the interest of money…The ports swarmed with [government officials], whose sole business was to inspect nearly every process of domestic industry, to peer into every package, and tax every article…”

This was written about France, just before it lost its place as the world’s most powerful nation, and it was published as a warning to Britain, just before it lost it’s superpower status. This quote applies perfectly to America today.

Great nations in decline need innovation and entrepreneurialism, but instead they choose anti-innovation and anti-entrepreneurial regulation. It’s amazing how every nation repeats this well-known but addictive path of self-destruction.

As Lane Kenworthy argues in Foreign Affairs, opponents of bigger government “are fighting a losing battle.” In the near future, he says,

“More Americans will work in jobs with low pay, will lose a job more than once during their careers, and will reach retirement age with little savings.”

But this will be offset, he suggests, by more vacation days, less working hours each week, and more government programs that pay for many of these people’s needs.

Many of the experts agree — he U.S. economy isn’t going to boom anytime soon, but this will be balanced for investors by significant economic successes in Mexico, South Korea, Poland, Turkey, Indonesia, the Philippines, and Thailand, among other places.

All of this adds up to an America on the verge of what Paul Kennedy called the “fall of great powers”: overreach in international affairs that spends much of the nation’s prosperity, and simultaneously too much government regulation at home — shutting down a nation’s innovative/entrepreneurial class at the same time that the government taxes and spends more and more.

This same pattern brought down the top leader status of Spain, France, Britain and the Soviet Union. Before these, it brought down Athens, Rome, and the Ottoman Empire. Unless the United States changes course, it is following this same blueprint for decline.

When historians look back on 2013, they may well see it as the tipping point to a rapid American downturn. Partisan conflicts, government spying on its own people, drastic government spending, constantly increasing regulation, the rapid rise of China — any of these could fuel real decline. Together they may be insurmountable.

But one thing stands out: In a nation desperately in need of innovation and entrepreneurial initiative, the government is handing out innovation-blocking regulations at a breakneck pace.

The good news in all this is that entrepreneurs don’t give up easily. Tenacity is part of their DNA. The future will be determined by this race between politicians (increasing regulations) and entrepreneurs (innovation and prosperity).

Whoever wins will lead the 21st Century.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Aristocracy &Blog &Business &Citizenship &Current Events &Economics &Entrepreneurship &Government &Politics