The Hillary/Trump Dilemma by Oliver DeMille

May 25th, 2016 // 6:12 am @ Oliver DeMille

Parties, Issues, and Funds

Mitt Romney was right about a number of things. One of the most important, even though it got him trouble with some voters, is that a solid 47% of the nation is against the Republican candidate for president (whoever he or she is), simply because a large group depends on government programs to financially make ends meet. In fact, the number appears to be increasing.

Mitt Romney was right about a number of things. One of the most important, even though it got him trouble with some voters, is that a solid 47% of the nation is against the Republican candidate for president (whoever he or she is), simply because a large group depends on government programs to financially make ends meet. In fact, the number appears to be increasing.

According to one report, “Nearly half of Americans would have trouble finding $400 to pay for an emergency.” The same article notes that “47 percent…would cover the expense by borrowing or selling something, or they would not be able to come up with the $400 at all.” (“My Secret Shame,” The Atlantic, May 2016)

Indeed, in 2014 only 38 percent of Americans thought they could come up with the money for a $500 car repair. (Ibid.) In other words, the number 47 percent (who needed government help to survive in 2012) may now be closer to 62 percent.

High and Low

This is a challenging dilemma. On the one hand, those with a sense of needing more government support and programs to make ends meet are a lot more likely to vote for Hillary Clinton or even Bernie Sanders than for any Republican. As the electorate becomes more financially strapped, it tends to swing to candidates promising more government help.

On the other hand, it is the liberal (Bill Clinton/Barack Obama) and moderate (Bush I/Bush II) policies—growth of government intrusion in the economy and poorly-constructed education, health care, banking and other programs—that have brought our economy to this point. As more people vote for bigger government, the government naturally grows and the economy further stalls. It’s a self-fulfilling negative cycle.

In a truly free enterprise economy, entrepreneurship would create a lot more jobs and prosperity. It brings approximately 80% of new jobs in the United States—but the sheer mountain of red tape a business start-up now faces (based mostly on the policies of the four presidents just mentioned, and more from Obama than the others), has significantly gummed up the economy. Obamacare is making it even worse, with the most damaging (job-killing) parts of the Affordable Health Care Act still slated to go into effect in 2017.

Between 2003 and 2013 the median net worth of Americans dropped an amazing 38%. (Ibid.) And it’s still going down.

In short: Big government isn’t helping—it’s adding to the problem.

Beginnings or Endings

Remember the 2012 presidential debates where Romney suggested that Russia is a major strategic threat to the United States and Obama scoffed and lectured Mitt about not knowing what he was talking about? Three years later, guess what? Russia a major strategic threat. (See Foreign Affairs, May/June 2016: “Putin Returns to the Historical Pattern,” “The Revival of the Russian Military,” “The Quest to Restore Russia’s Rightful Place,” “Why Putin Took Crimea.”)

The same is true in economics. Bigger government, thousands of additional business- and job-stifling regulations on the books, and more red tape, don’t help the economy. They hurt it.

And a majority of Americans are now feeling the effects. Fifty-five percent of households don’t have enough savings to make it for even one month. (Op Cit., The Atlantic) If the middle twenty percent of households, the true middle class in America, lost their income right now, they could, on average, continue their current lifestyle for just six days. (Ibid.) That’s six days!

The sudden 2016 “defaults on subprime auto loans indicate that the American willingness to just keep buying…can’t lift us out of this [economic] pickle…. The general default rate for all subprime auto loans jumped from 11.3 to 12.3 percent in just a month—exactly the kind of ‘can’t pay my bills’ phenomenon that triggered the [2008] housing collapse.” (“The Portfolio,” Esquire, May 2016)

Recently announced: Sports Authority is filing chapter 11 bankruptcy, Staples is closing 50 stores, Fairway is near default, American Apparel filed for bankruptcy, and even Walmart is closing 154 stores. (Ibid.) The list of other companies on the brink or downsizing and cutting jobs is long.

The economy is sputtering.

All this in the midst of a presidential election year. I don’t know what Donald Trump will or won’t do in the Oval Office (whether he’ll be just another politician or really lead out and reboot the economy). But one thing is very clear: If Senator Clinton is our next president, the number of Americans who require government support to make ends meet by the year 2020 probably won’t be 47 percent, or even 62 percent, anymore.

It will be a lot higher.

Category : Aristocracy &Blog &Business &Current Events &Economics &Entrepreneurship &Government &Liberty &Mini-Factories &Politics &Producers &Prosperity

3 Things We Aren’t Talking About Enough by Oliver DeMille

May 19th, 2016 // 8:19 am @ Oliver DeMille

These three things are big deal. A very big deal. They’re floating around there in the back of our minds, but we don’t talk about them very much in our current society.

These three things are big deal. A very big deal. They’re floating around there in the back of our minds, but we don’t talk about them very much in our current society.

We need to start.

I

First, it is clear to almost everyone that the Drone Revolution has drastically changed the world—probably in ways that we can’t really undo. Whatever other functions they’ll eventually fulfill, drones are the ultimate war machine. They can be programmed to do things unimagined in earlier wars, like search out specific people from certain races, religions, viewpoints, business or educational backgrounds, etc.

They can be programmed to target a specific person. And all his/her friends. Everyone he/she loves. Those who agree with him/her on political issues. Governments can use drones on their own people, as well as in battle.

Very few people are taking this very seriously. On the one hand, it’s so potentially monstrous that we don’t like to think about it. Imagine drone technology in the hands of a Stalin, a Hitler, a Nero, Caligula or Mao, Saddam Hussein or an ISIS sympathizer in your neighborhood. If history has taught us anything, it’s that bad guys do sometimes rise to great power.

It will happen again, and drone tech combined with computing power is a recipe for disaster.

On the other hand, if we did want to stop it, what would we do? Most people believe it’s a fait accompli. No chance of turning it around. They’re probably right.

II

Second, the Crowdsourcing Revolution isn’t over—it’s just beginning. It has largely put the newspaper industry on the ropes, and the book industry is also now under the gun as Amazon grows. In fact, many brick and mortar malls are increasingly empty as Internet sales on many types of products and services soar. Education at all levels is facing serious competition from free online learning sources, and big swaths of the health care sector are being crowdsourced as well.

The good side of crowdsourcing makes a lot of things less expensive, easier to find, and quicker to obtain (or learn). The downside is that the large companies that control the data have algorithms that can influence us in ways we never imagined. For example, a man texts his wife to find out where a certain kind of cereal is in the pantry, and within minutes his smartphone chimes and offers him a coupon for the same cereal—from the supermarket closest to his home. Or if he texted from the office, it lists the grocery store nearest to his work.

This kind of data-mine-marketing is becoming a commonplace experience for those who use certain apps, and while it might feel a bit creepy at first, over time people get used to it—and even grow to expect it. Very Minority Report. How much governments and private organizations are using this kind of tech is unclear, but it’s growing. Add personal location tracking technology to the mix, and we really are living in a surveillance state.

III

Third, there’s a new buzzword floating around in economic circles: “Crowd-Based Capitalism.” The idea is that in the emerging 21st Century economy we’re evolving a whole new economic model. Not socialism. Not capitalism. Certainly not free enterprise. A new approach. As one book from MIT put it, we’re moving into a “Sharing Economy,” where “the end of employment” is being replaced with “the rise of crowd-based capitalism.”

The idea that employment as we’ve known it for the last six decades is increasingly outdated. For example, in the May 2016 issue of The Atlantic an article showed how one couple used up their entire life and retirement savings—and the entire life savings of the husband’s elderly parents—to put their two daughters through college. The idea of college training being essential is now being taken to incredible levels: The savings of two couples wiped out, just so their offspring could graduate with a degree—in an economy that doesn’t value degrees like it used to. (See “My Secret Shame,” The Atlantic, May 2016)

A truly new economy is emerging, but most people haven’t realized it yet. They’re still caught in the old—and paying for it in tragic ways.

Another example: When 2016 presidential candidate Ted Cruz said the following, “The less government, the more freedom. The fewer bureaucrats, the more prosperity. And there are bureaucrats in Washington right now who are killing jobs…”, the response was immediate. Two professors, one from Yale and the other from Berkeley, replied that the opposite is true: The bigger the government, the more freedom, and the bigger the bureaucracy, the more prosperity. (“Making America Great Again,” Foreign Affairs, May/June 2016)

A lot of people actually believe them.

But reality is still reality. Crowd-based capitalism means more government, and this isn’t the path to a great economy. The thing that is actually rising to replace the 1945-2008 era of employment it is a reboot of entrepreneurship and small business ventures.

The new economy can go in one of two directions:

- Government reduces the amount of anti-business and job-stifling regulations, and spurs a major entrepreneurial boom. This will create a lot more jobs, opportunities, and incentives for increased global investment in the U.S. economy.

- Government keeps increasing business-stifling regulations and takes the profits from businesses (big and small) to create a “sharing economy.” This will create a much higher rate of dependency on government welfare and state programs, reduce the number of people fully employed (making enough to live in the middle or upper class), and drive investment to other nations.

How the so-called “sharing economy” differs from socialism is actually academic. Yes, on paper it has a somewhat different structure than Marxian socialism. But for the regular people it’s going to feel pretty much the same. A few wealthy and powerful elites at the top, a small middle class of managers and professionals who work mostly for the elites, and a burgeoning underclass living largely off government programs.

Two books* on this topic are: (1) The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism by Arun Sundrarajan, and (2) Saving Capitalism: For the Many, Not the Few by Robert Reich.

For the other side of the argument—why freedom and free enterprise are the real answer—see my latest book, entitled Freedom Matters.

Middle America is still experiencing a serious economic struggle. Things are getting worse, not better. As one report on the heartland put it: “On every sign, in every window, read the vague and anxious urgings…Remember the Unborn; …Don’t Text; Don’t Litter; Buy My Tomatoes (Local!); Let Us Filter Your Water; We Can Help With Your Bankruptcy. Then bigger gas stations sprawled on crossroad corners, unoccupied storefronts…another consignment store.” (“The Country Will Bring Us No Peace,” Esquire, May 2016)

As an ad for Shinola products reminds us: “There’s a funny thing that happens when you build factories in this country. It’s called jobs.” We haven’t seen very many factories built here for a long time. Crowd-based capitalism isn’t a solution.

Conclusion

Together, these three changes in our world are a very big deal:

- The Drone Revolution

- The Crowd-Sourcing Revolution

- The Post-Employment Economy

If you have more ideas on these important developments, share them. If not, learn more about them.

The future can be determined by a few elites who think about such things, or by all of us. The more regular people engage such important topics, the more influence we’re likely to have.

The truth is, we’ve forgotten Watergate and Kent State. (See “The Cold Open,” Esquire, May 2016) We’ve forgotten Nixon and that the 2000 presidential election was decided by the intervention of the Supreme Court. (Ibid.) We’ve forgotten a lot of things.

As one report put it: “We’ve forgotten how easily we can be lied to.” (Ibid.) If we let them, Washington and the media will just tell us what the elites want us to know—and think.

*affiliate links

Category : Aristocracy &Blog &Business &Culture &Current Events &Economics &Entrepreneurship &Generations &Government &Independents &Information Age &Liberty &Mini-Factories &Politics &Postmodernism &Prosperity &Technology

The Real Crisis of the 2016 Election by Oliver DeMille

September 10th, 2015 // 6:30 am @ Oliver DeMille

“U.S. median income is $42,000 per year, while the European median income is $27,000. That’s close to the average difference in annual income between U.S. high school grads ($28,000) and college graduates ($45,000). And the current elite class wants America to become more like Europe. This explains much of what Washington is doing these days.”

What Is Coming

There is a serious crisis coming. Most people just hope it won’t come. Their subconscious minds tell them: “If we hope hard enough, and avoid thinking about it, maybe it won’t happen.”

There is a serious crisis coming. Most people just hope it won’t come. Their subconscious minds tell them: “If we hope hard enough, and avoid thinking about it, maybe it won’t happen.”

Sadly, it isn’t quite that simple. The crisis is coming.

What’s the Crisis? Imagine this: It’s the summer of 2017, and we have another career politician in the White House. On the day of the 2016 election, or even earlier, we learned that none of the anti-Establishment candidates were going to win. Instead, the media informed us that the American electorate was putting another regular politician into office.

And since inauguration day, that president has followed a path similar to earlier presidents, from Bush I and Clinton, to Bush II and Obama: the national debt is still skyrocketing, our foreign policy is a disaster, the government is growing, increased regulations attack our prosperity every month, and the Supreme Court is legislating additional policies that hurt the nation.

On top of all this, the mandates of Obamacare are really kicking in now, increasing many small business costs by 30% or more annually—and as a result, those businesses that survive are laying off large numbers of employees. Your family health insurance premiums are up many thousands of dollars a year. The economy is still struggling, with less than a 2% growth rate, and good-paying jobs are increasingly scarce. At least one or two of your close friends or family members have lost their jobs.

In other words, it’s clear that the 2016 election has changed almost nothing. Terrorist attacks are increasing in both Europe and a few targeted attacks in the United States—as Iran uses its new $100 billion dollars to fund such violence. ISIS is still spreading, and China continues to increase its naval presence around the Pacific Rim. Moreover, Putin is becoming increasingly aggressive, not just in Eastern Europe but also in Syria, the North Pole, and the Pacific.

If the new president is a Democrat, there is a strong push to increase taxes and federalize even more state-level programs. If, contrast, if the president is a Republican… well, exactly the same thing is happening.

If we vote for the same kind of candidate we’ve voted for since 1988 (a career politician), we’re going to get the same thing we’ve experienced since…you know…1988. Meaning that career politicians are going to give us the same thing that career politicians have always given us:

Increased government. Very little positive change. A continual slide toward bigger government, higher debts, and decreased individual prosperity and freedoms.

Coming Paths

This is the crisis ahead: More of the same. Except that it’s continually a bit worse, year after year, election cycle after election cycle.

“The definition of insanity,” you remind yourself, “is to keep doing the same thing while expecting different results.” In business, the prime directive is that to actually change an organization, you have to significantly change the leadership. If career politicians keep running the White House, little is going to change. This is true.

It’s frustrating. We don’t want to believe it, because we hope things will be different this time. But each election proves that it’s the reality. Career politicians do what career politicians do. Over and over.

Specifically: whatever career politicians say as candidates, once they’re elected they do what they’ve done before. Count on it. The following presidential candidates are not going to bring much change to Washington:

- Joe Biden

- Hillary Clinton

- Jeb Bush

- Chris Christie (to his credit, Christie is openly promising to do what career politicians do: just more of the status quo)

- Marco Rubio

- Scott Walker

- John Kasich (actually, at least Kasich has balanced two major budgets—the federal budget during the 1990s, and Ohio’s budget while serving as governor; thus, he’ll likely do this again—even if he doesn’t do much else, this is a pretty good thing)

But does anyone actually believe that if Jeb Bush is elected president we’ll reverse the national debt, repeal Obamacare, or seriously send education decisions and funding back to the states, where it belongs? No way.

The above candidates are part of the system; and reaching the pinnacle of the system they’ve spent their lives supporting won’t incentivize them to drastically change things. Whatever your political views, it’s clear that those who’ve made their lives in the system aren’t likely to alter it in any significant way. Period.

The following are a lot more likely to really change things:

- Bernie Sanders

- Carly Fiorina

- Rand Paul

- Donald Trump

- Ted Cruz

- Ben Carson

Say what you want about them, but they aren’t part of the typical Washington Establishment.

If elected, would one of them actually change things?

Maybe. Maybe not. But there is at least a chance.

In contrast, with the first list above, there’s no reasonable, rational expectation of real change.

Part II: What Will the Crisis Look and Feel Like for Americans?

Beyond the question of whether or not real change will come after the 2016 election, a deeper question is this: “If it doesn’t come, what will happen?”

In other words, “Where is our current national trajectory taking us?” First of all, if real change does come, it could take a number of different directions. That’s what change does. Genuine change is almost impossible to predict, because a significant change causes so many additional, cascading, changes.

If anyone on the first list above becomes our next president, I believe we have less than a 1% chance of changing course in a serious way that really shifts our national direction. Even if someone on the second list is elected, I’m convinced we’ll have less than a 40% chance of such a course correction (and 0% if it’s Bernie Sanders).

And let’s be clear: a course correction is desperately needed. If it doesn’t come, where are we headed?

Answer: In the early 1960s, many in the Euro-American elite class adopted the idea that the U.S. was beginning to outpace the nations of Western Europe—economically, technologically, and militarily. Moreover, they calculated that such a divide would be bad for business (specifically the business of the elites, which includes both the economic endeavors of the 1% and also their political influence).

To combat this growing divide, the elites began using their institutional, fiscal, and monetary influence to make the United States more like Europe. They began in earnest by dropping the gold standard in 1971, and providing an influx of elite money into higher education donations and endowments, and simultaneously with increased investment in and ownership of major media outlets.

Influenced by these funds and those who provided them, education began spreading the idea that America should be more like Europe, and the graduates of these programs increasingly dominated the campus scene through the seventies and eighties. By 1987, Allan Bloom decried what amounted to the Europeanized politicization of higher education in his bestselling book The Closing of the American Mind.

Choosing a Dream

Media increasingly reinforced this same message—“America should be more like Europe”—in stories and reports, from the major national newspapers to the Big 3 television networks. Nearly all cable channels and Establishment-supported Internet news outlets followed suit.

Among Establishment policy makers, Samuel Huntington’s writings on “Civilizations” and Francis Fukayama’s “End of History” essays pointed U.S. financial-, domestic-, and foreign-policy institutions (and bureaucracies) in the same direction.

Where does this leave us today? The “American Dream” includes the ideal that each household should achieve home ownership, financial independence (at least by the time of retirement), cars, savings, education for the kids, and a better lifestyle for each additional generation. In contrast, a middle class family in Europe typically lives in an apartment, has fewer children than American families, owns (on average) less than one car, and expects decreasing financial opportunities for coming generations.

To put this in financial terms, the U.S. median income is $42,000 per year, while the Western European median annual income is $27,000.

While it may not appear so at first, these numbers are drastically different—especially if you are applying for a home or vehicle loan, trying to start a business, deciding how many children to have, or funding a child’s college education. Indeed, an American family of three making the European median income of $27,000 a year typically lives in an apartment and has approximately $4,050 a year or less in disposable income. The U.S. median income of $42,000 upgrades the family to a home and $12,180 in annual disposable income.

That’s roughly the same as the average difference in annual median income between U.S. high school grads ($28,000) and college graduates ($45,000). That’s right: the direction of U.S. median income is headed toward less than the average wages of high school grads.

This comparison is not overstated. This is where we’re headed. Of course, the affluent classes won’t suffer this same fate, but a lot more Americans will become part of the struggling class. Just like in Europe.

Who we vote for matters.

If we want real change, we need to vote for something different.

Category : Aristocracy &Blog &Business &Citizenship &Community &Constitution &Culture &Current Events &Economics &Education &Foreign Affairs &Generations &Government &History &Independents &Leadership &Liberty &Politics

TJEd & College PART I: A Report on the Growing Importance of Higher Education

May 19th, 2015 // 6:40 am @ Oliver DeMille

The Divide

A college-level education is increasingly important in the new economy. Higher education has long created a significant divide between the “haves” and “have nots,” and by all indications this trend will intensify for the next three decades.

The gap between the affluent (we’ll call this the A Economy) and the middle class (the M Economy) is growing, and higher education is one of the clearest differences between these groups. The ranks of the lower classes (the R Economy—with R standing for “Risk”) are swelling, as more in the middle class find themselves caught in high debt and paycheck-to-paycheck living. Again, higher education marks the divide between those in the A Economy and almost everyone else.

Moreover, as North Americans compete for well-paying jobs and economic success in an increasingly global marketplace, the old system of “college degree = secure job with good benefits” no longer holds. Fewer graduates are able to maintain their parents’ lifestyle, and the middle class is dwindling.

As a result, those in the Middle Economy are left with a choice: rise to the Affluent Economy or join the Risk Economy. With career opportunities increasingly elusive for young people in this environment (in both North America and Europe), higher education has become even more important.

There is much more to this article – including where the different classes are heading; various ways of getting a great education; finding where to get your college-level education; and more!

Category : Aristocracy &Blog &Business &Citizenship &Community &Education &Entrepreneurship &Prosperity

America’s Looming Crash: Special Report Parts I, II, III

January 9th, 2015 // 7:56 am @ Oliver DeMille

I am an optimist. I believe the best of America and the world are still ahead. But we’re only going to get there by dealing with the reality that the United States is now in an era of significant decline. Specifically, at least two things happened this year that are major problems, and a third serious problem is gaining increased support among many world leaders.

Part I

First, our federal debt went over the $18 trillion mark in 2014. Someone is going to have to pay this back, and that means we’ll be paying for it for the rest of our lives—and so will our children and grandchildren.

First, our federal debt went over the $18 trillion mark in 2014. Someone is going to have to pay this back, and that means we’ll be paying for it for the rest of our lives—and so will our children and grandchildren.

That’s approximately $58,065 for every man, woman, and child currently in the United States. If you have a family of four, you now owe around $232,260. This debt must be paid in addition to whatever other taxes are needed for national security, services, and all other government programs now and going forward–not to mention your family’s living expenses.

To be more realistic, the truth is that many people will never pay any taxes toward this amount—because they won’t make enough. This means you’re likely to end up being charged at least twice this amount. Some people will pay a lot more. So you really owe more like $116,130 or $464,520 for your family of four.

If you have big family, say of ten people, you owe roughly $2 million dollars over the course of the rest of your life. Whatever you don’t pay off, the government will charge your kids and grandkids.

Oh, and you need to add to that all the interest still to be charged on this amount, which means that you actually owe between $1.8 million if you have a family of four, or up to around $7 million if your family is bigger. And, yes, if interest rates on the national debt increase (all the trends indicated they will), this amount will go up rapidly.

Most people have no idea what a big deal this is. This is money that has already been spent. It’s owed. And we have to pay it, now and later. We, our kids, and their kids too.

Problems and Booms

How big is this? Multiply your salary by the number of years you have left working (x), and then multiply at least $116,130 by the number of years you have to live (y). If you make more than $60,000 a year, double both amounts. If you make more than $100,000 a year, quadruple both. Then subtract one from the other to find if you’ll make more than you already owe the government.

Too much math? That’s exactly what the government is banking on. The government only gets away with this level of borrowing and spending because very few people do the math or understand what it means to them personally. Granted, these numbers are very basic, and the reality is actually worse, given interest and rising interest rates on the national debt.

So, the United States has a problem. It has a number of problems, actually, but this one is massive. The government owes so much that our economy will struggle under the weight of this debt for the rest of the century. It will dampen every citizen’s opportunities, block every generation’s choices, and haunt our posterity for many decades.

Is there any way out of this? Yes. The answer is simple, in fact. We need a major economic boom. A massive boom would allow us to pay this off much quicker and put the nation back on positive economic footing. Without such a boom, this problem is going to deepen.

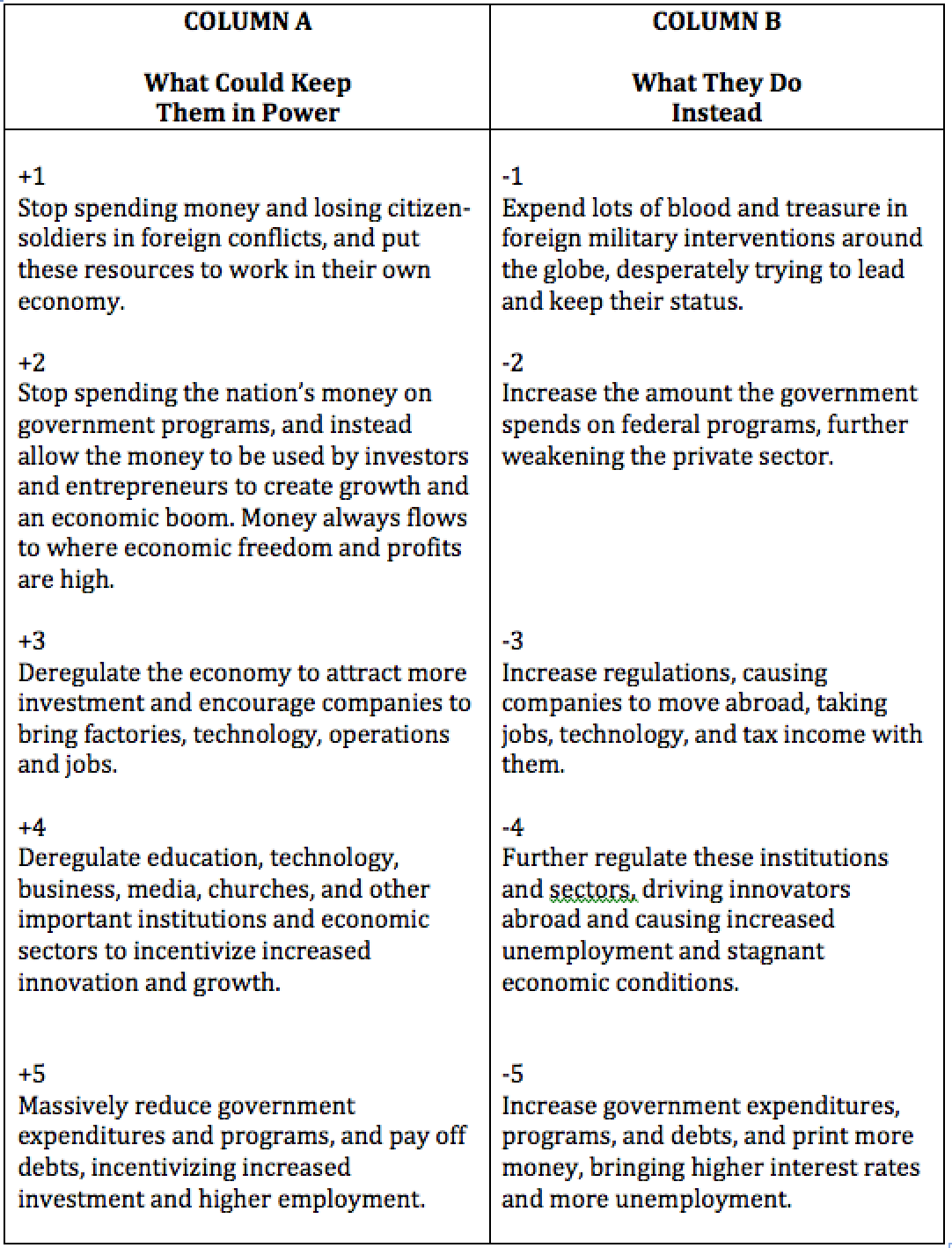

How do we get a boom? Again, the answer is simple. I’ll outline it below in Column A.

But first, what happens if we don’t make the choices that will bring a boom? The answer is clear. And drastic. Our economics will rapidly get worse. For the nation, for families, for almost everyone.

Part II

Second, China just surpassed the United States as the top producing economy in the world. It was already the top trade economy, as of a year ago. How does this translate into real life consequences for real people? Well, such a transition has happened before, and there is a predictable pattern that occurs when a new nation becomes the largest global economy.

Here is a rough outline of this pattern:

- The new power (e.g. China) has the ability to dictate its own trade rules, which increases the flow of wealth to it—and away from the old power (e.g. the U.S.).

- The new power’s currency eventually becomes the lead world currency (replacing the old power’s currency). When Britain lost it’s top power spot, the average British citizen lost 30% of net worth within weeks. In the current shift, the Chinese will likely push for a global currency. (More on this in Part III)

- The old power keeps trying to regain its status by engaging in wars and military interventions around the globe, while the new power focuses mainly on economic success. This further weakens the old power, and quickly.

- The new power, with its booming economy, is able to enjoy lower interest rates, less debt, fewer expenses for international conflicts, and much higher rates of savings and investment. The wealth of the world flows into the new power as investment capital, lifting the entire new power’s economy. The old power sees its standard of living drastically fall, while the new power watches its standard of living rapidly increase.

In the eighteenth century the old power was Spain and the new power was France, in the nineteenth century the old power was France and the new power was Britain. In the twentieth century the old power was Britain and the new power was the U.S.

Today, and in the years ahead, China is the new power, and the United States is the old power. As Brett Arends put it:

“This will not change anything tomorrow or next week, but it will change almost everything in the longer term. We have lived in a world dominated by the U.S. since at least 1945 and, in many ways, since the late 19th century.

“And we have lived for 200 years—since the Battle of Waterloo in 1815—in a world dominated by two reasonably democratic, constitutional countries in Great Britain and the U.S.A. For all their flaws, the two countries have been in the vanguard worldwide of civil liberties, democratic processes and constitutional rights.” (Brett Arends, “It’s Official: America is now No. 2,” Market Watch, December 4, 2014)

China’s influence will certainly go in a different direction. This may be the single biggest concern of our century.

Can we do anything to reverse this trend? The answer is “Yes.”

Failure by Surrender

There is an irony to how old powers lose their leadership role. The old power usually has the ability to stay the top leader, if it chooses. But is seldom does. Why? The answer is instructive.

Old powers refuse to maintain their leader role because they make a series of bad choices:

Both Are…

This is so predictable that following the pattern of decline again in our time is ridiculous. The U.S. continues to follow this path, however. Part of this is spurred by collectivist ideological ideas, but the ultimate blame goes to voters who aren’t willing to back candidates who support truly frugal economic choices to cut government programs and incentivize a free-enterprise economic boom (Column A).

Voters in traditionally powerful nations are accustomed to lavish government programs; they vocally decry government debt, but they vote for more government programs anyway. Conservatives and liberals disagree about what to spend money on, but they both increase the size of government.

One problem is that people from both sides of the political aisle blame the other. Liberals fault conservatives for supporting continued military interventions around the world, and conservatives blame liberals for increased government programs and spending.

The truth is that both are right. Liberals adopt Column B government spending and bad anti-business regulations, and conservatives support Column B global military interventions around the world. Both kill the power and economy of the nation. In our day, both of these drastically decrease American prosperity and power and lift China to global leadership.

In simplest terms: Both are bad. But Republican voters hold on to their support of U.S. interventions in Europe, Africa, the Middle East, Asia, etc., and Democratic voters refuse to stop promoting big-spending federal programs. In our two-party system, both parties are deeply committed to Column B, though for different reasons.

If the United States keeps following this pattern, our looming crash is inevitable. If not, if we reverse it and move toward an economic boom (by adopting Column A), we’ll reboot and reestablish the top producing economy in the world.

It’s up to us. Boom or crash. The choice seems simple, yet voters keep electing leaders who implement Column B rather than Column A. If we keep it up, we’re going to get what we deserve. A crash.

In all this, the most amazing thing is how simple it would be to create a boom. Column A is direct, do-able, realistic, real. We just have to adopt it, and apply it. But if we won’t even vote for it, it won’t come.

Part III

Third, changes in the world’s currency system are gaining momentum. Few Americans realize how significant these two changes ($18 trillion in federal debt and counting, and the loss of the “#1 producing economy” status to China) will be. For example, just consider the impact of the dollar being replaced by something else as the world’s reserve currency.

While most people prefer to leave currency discussions to the experts, such head-in-the-sand behavior can’t shield them from the consequences. The next reserve currency will be the dollar, if only the U.S. adopts the items in Column A and catalyzes a major American economic boom.

If not, it will be something supported by China. Specifically, look for it to have three characteristics that will drastically restructure the entire world:

- It will likely be a global currency, meaning that the international community (with China in the #1 spot) will regulate its use. This could easily result in a drastic reduction of national sovereignty around the world and in the U.S.

- It will almost surely be electronic, which will give governments massive controls over people. This amounts to at least some controls from China, not just your national government. The power of regulating electronic currency is almost impossible to overstate.

- It will also likely be sold with biotech, meaning that to access your electronic money you’ll need your finger print or eye scan. (See Molly Wood, “Augmenting Your Password-Protected World,” The New York Times, November 5, 2014) This will provide global surveillance at an unprecedented, literally more than Orwellian, level. Again, China will be a top influence (perhaps the top influence) in how this system is administered.

These three massive shifts in our world reality are mostly hidden from our view. They are reported, but few people realize how significant or personally relevant they are.

The future of our nation, our economy, and literally our society (with its God-based ideals, freedom-based values, and free enterprise economics) are at stake. If Column B prevails, an American Crash is assured.

(Oliver DeMille addresses the solutions to these challenges in his book, The United States Constitution and the 196 Principles of Freedom, available here)

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Oliver DeMille is the New York Times, Wall Street Journal and USA Today bestselling co-author of LeaderShift: A Call for Americans to Finally Stand Up and Lead, the co-founder of the Center for Social Leadership, and a co-creator of TJEd.

Among many other works, he is the author of A Thomas Jefferson Education: Teaching a Generation of Leaders for the 21st Century, The Coming Aristocracy, and FreedomShift: 3 Choices to Reclaim America’s Destiny.

Oliver is dedicated to promoting freedom through leadership education. He and his wife Rachel are raising their eight children in Cedar City, Utah.

Category : Business &Citizenship &Community &Constitution &Culture &Current Events &Economics &Education &Entrepreneurship &Featured &Generations &Government &History &Leadership &Liberty &Mini-Factories &Mission &Politics &Statesmanship